Positive signs emerge as buyers’ market strengthens

Download October Sales and Listings Statistics Houses Townhouses Condos

Download October Sales and Listings Statistics All Regional

Highlights of the October Report

Lowest benchmark home price: New Westminster at $809,800

Highest number of Greater Vancouver sales since June 2022

Benchmark home price is down 9.2% from six months ago

North Vancouver average home prices up 8.5% from September

West Side detached house sales highest in six months

Immigration surge will drive housing demand higher

The October housing market in Metro Vancouver revealed an economic truism: ‘the cure for higher prices is higher prices’ and that cure is bringing local housing sales and starts back to balance after a rollercoaster year.

This has swung to a buyers’ market that is gaining momentum and may soon appear irresistible.

Cast your memory back to the misty past of 9 months ago, when the benchmark detached house price in Greater Vancouver was $2.04 million, multiple offers were more common than not, property sales were cresting over 3,400 a month and monthly new condo starts were running above 650 units.

Higher prices and interest rates changed everything.

By October 2022, the detached house price had fallen to $1.89 million, housing sales were down to 1,903 for the month and multiple offers are less common. New condo starts dropped 30% from February to just 458 in October as builders struggled with soaring land and construction costs. The only number higher is the mortgage rate, which has basically doubled after six increases, the latest on October 26.

We are now seeing the ramifications of higher prices and the news for home buyers is now quite positive.

There are now five Greater Vancouver mainland markets where the overall composite benchmark home price is below $1 million: New Westminster, Burnaby North, Port Coquitlam, Pitt Meadows and Maple Ridge. Six months ago there was 1.

Those seeking to buy a Greater Vancouver home in virtually any market now can expect to pay tens of thousands of dollars less than just a few months ago. The overall benchmark detached house price in October, for example, was $201,500 lower than in May; townhouse prices are $97,500 less expensive; and the benchmark condo apartment price is $52,600 below the level of six months ago.

While home prices have fallen by 9.2% in six months, the average mortgage rate has increased about 3%.

Meanwhile, easing land prices and construction costs promise to bring cancelled or delayed strata projects back to life, likely at lower prices.

Altus Group reports that the average commercial land prices in Metro Vancouver this year have fallen from a high of $4.7 million an acre in the second quarter to $3.3 million in the third quarter, according to preliminary data, which is a dramatic change. Demand for multi-unit residential development land has also fallen with the dollar volume down 50% year-over-year as of mid-2022, to less than $1 billion, while a slowdown in new strata buildings has led to less demand and lower costs for construction materials and labour.

Also, the 50-basis point increase in the Bank of Canada rate on October 26 is a signal that rate increases are slowing and may stop this year. The rate increase was widely expected to be even higher. On October 26, Bank of Canada governor Tiff Macklem said, ” This tightening phase will draw to a close.”

With Canadian housing sales falling year-over-year and inflation fears easing, we may have seen the last interest rate hike for this year, perhaps even into 2023.

Then we have the rental pressure that may drive more tenants into homeownership and more condo investors into the market.

Right now, due to the continual shortage, average rental prices in Metro Vancouver are the highest in Canada. As one landlord confided recently, there is little incentive to improve rental stock because, without other options, most renters pay what the landlord feels the market can bear. New or renovated one-bedroom apartments in Vancouver are now asking rents of $3,000 per month, which is enough to cover a $600,000 mortgage.

At this rate, it is now, or soon will be, less expensive to buy an apartment than to rent one. This, in turn, will encourage more investors to purchase a condo to place on the rental market, especially if the provincial government, as planned, legislates that all Strata Corporations must allow rentals.

As well, with the federal government announcing that it wants to increase immigration numbers to 500,000 by 2025, the demand for housing in B.C. is only going to grow. In 2023 Canada hopes to see immigration at 465,000, with skilled labour being a focus.

Governments now realize it must work on supply to increase housing – demand side measures just aren’t going to cut it anymore.

What we have today is a leaner and less mean residential market that should draw nimble buyers back into action and allow listings to increase as sellers and developers become more confident. We can thank higher prices earlier this year.

Here is a look at regional markets for October 2022

Greater Vancouver: Total housing sales in October, at 1,923, were 13% higher than a month earlier and the highest for any month since June 2022, yet still down 45% from October 2021. Compared to October 2021, townhome sales are 49% lower, condo sales 46% lower, and detached home sales down 52%. Detached house sales made up 30% of all transactions in October, while townhouses had a 17% share. Apartment sales accounted for the bulk of the market, with 52% of sales. Total sales were 33% below the 10-year average for the month. The overall average (not benchmark) price for all residential properties was $1,231,759. This is down about $110,000 from the peak in February 2022 and approximately $10,000 below the average price in October 2021. (Average prices often give a raw and accurate example of market performance.) Active listings were at 10,305 at month end compared to 8,492 at that time last year and 10,424 (down 1%) at the end of September. New listings in October were down 5% compared to September 2022, down 0.5% compared to October 2021. Month’s supply of total residential listings is down to 5 month’s supply, considered a balanced market, but leaning towards a buyer’s advantage. October’s sales-to-listings ratio of 47% compared to 39% in September 2022 and 86% in October 2021. What’s really telling is that in October 2018 when sales were at a similar level as this October, new listings were 19% lower this October compared to 2018.

Fraser Valley: The Fraser Valley saw 901 total residential sales in October, down 53.5% from a year earlier, but up a scant 0.4% from September 2022. October ended with a total active inventory of 5,642 properties for sale, up 63.7% compared to October 2021. With a sales-to-active listings ratio of 16 per cent, this is a buyer’s market for the fifth straight month. Benchmark detached house prices are down just 0.8% from a year earlier and off 1.8% from September 2022, at $1,436,400. At $809,800, the benchmark townhouse price decreased 1.5% compared to September 2022 and increased 7.7% compared to October 2021. Condo apartments sold at a benchmark of $527,900, down 0.5% compared to September 2022, but up 11.5% compared to October 2021.

Note to landowners, including detached house owners and those with small acreages along the new SkyTrain corridor to Langley are seeing record-setting land prices. In October, a one-acre assembly near the planned 152nd Street transit station sold for $6.5 million.

Vancouver Westside: Despite all the angst and hand wringing, a look into the Westside detached housing scene – which, let’s be honest, is Canada’s bellwether market – shows October was a lot better than most would think. The 73 detached sales in the month represented 50% of the new listings last month – the highest sales-to-listing ratio since February – and the average sold price was $3,494,589. Fairly impressive. Total residential sales in October were 342, down 43% from a year earlier but up 14% from September 2022. Condo apartment sales led the October curve, posting 236 transactions at a benchmark price of $827,700, up 0.7% from September 2022, the first month-to-month price increase in at least 6 months. Townhouse prices have been rising for three months, to reach a benchmark of $1,477,700 in October. With an overall sales-to-listing ratio of 40% or a 7 month supply availalbe, the Westside is close to a balanced market, but we see an opening for buyers in this aspirational community.

Vancouver East Side: Total detached house sales in October were down a startling 51% from a year earlier to just 56 houses, the same as in Coquitlam. But the East Side detached house price was less than in Coquitlam. In fact, it is less expensive to buy a house on the East Side than in any suburban market except Maple Ridge-Pitt Meadows, Port Coquitlam or South Delta. East Side house prices now cost 11.5% less than 6 months ago, and we think, at a benchmark of $1,719,100, they offer perhaps the best value in the Lower Mainland. East Side condo apartment prices are now benchmarked at $678,900 and have been declining an average of 1% per month for six months. East Side benchmark townhouse prices in October were 2% lower than a year ago, at $1,028,500. Total East Side housing sales in October were 194, up 9% from a month earlier. The sales-to-listing ratio is running at 44%, fairly healthy, and there is about a 6 month supply of listings in this balanced market.

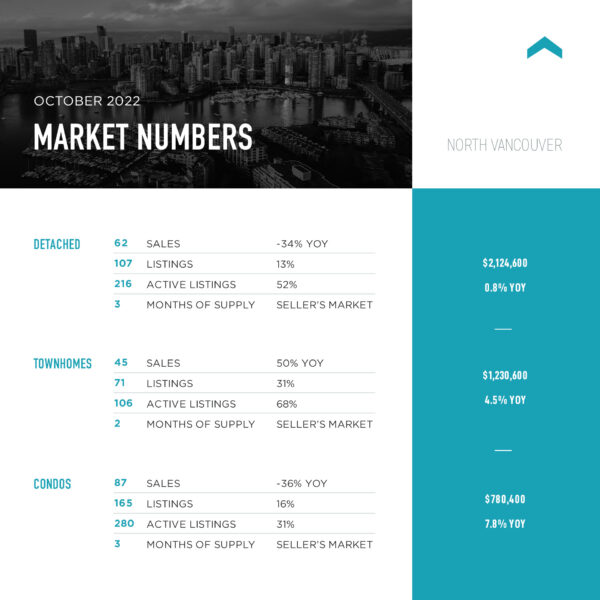

North Vancouver: A total of 195 residential properties sold in October, up a thundering 52% from September 2022, and the composite benchmark home price rose 0.8% month-over-month to $1,330,800. Detached house prices increased 1.5% from September to $2,124,600. With a 56% sales-to-listing ratio in October and the total inventory down to a 3 month supply, this is perhaps the strongest seller’s market in the Lower Mainland.

West Vancouver: Only 47 residential properties sold in October, up from 42 a month earlier but 48% less than in October 2021. This is a buyer’s market for those who aspire to live in one of Canada’s wealthiest neighbourhoods. There is a generous 13 month supply of homes on the market, 589 in all, and the sales-to-listing ratio is a low 22%, about the same as in October 2018, which was one of the slowest months on record. Despite all this, the composite home benchmark price in West Vancouver is $2,732,300, up 1.1% from September 2022 and nearly 2% higher than a year ago. The typical detached house sold in October for $3,317,500, also slightly higher than in September 2022.

Richmond: Richmond will likely see an influx of buyers, especially from Hong Kong, which has already sent a huge flow of residents this year. Total home sales in Richmond shot up 16% from September to 243 in October though they were down from 49% from the hectic pace of October 2021. The composite home benchmark price has declined 6.6% over the past six months to settle at $1,121,200 in October. There is just a 5 month supply of homes on the market, and the sales-to-listing ratio is a healthy 53%. This is technically a balanced market, but buyers and investors should be paying attention.

Burnaby East: Burnaby East, which borders New Westminster, has the lowest benchmark detached house price in Burnaby, at $1,826,700, but it also has the fastest rising house prices in the municipality. In October detached prices were up 2.3% from a month earlier and 7.6% higher than a year ago. This is a smaller market, with just 22 total residential transactions in October, but this was up 47% from October 2021, a rare increase for any Metro market. The supply of total residential listings is down to 3 month supply and the sales-to-listing ratio is 63% for the past two months. This is a seller’s market to watch.

Burnaby North: Some of the most amenity-rich condo projects in Canada are in North Burnaby’s Brentwood area – a new development will boast a 2.75-acre outdoor “beachfront” and running track plus an indoor bowling alley – so it is not surprising that condos sell well. Yet the benchmark condo price is $711,900, the lowest in Burnaby and well below the Greater Vancouver benchmark. Total residential sales in October reached 96, down 14% from September and 50% lower than in October 2021. Detached houses sold in October at $1,946,300, down 8% from six months earlier. Yet this is a seller’s market, with just a 4 month supply of listings and a sales-to-listing ratio of 48% in October.

Burnaby South: Burnaby South posted 122 housing sales in October, up 27% from a month earlier but 46% lower than in October 2021. The composite benchmark home price, at $1,064,300, has declined 10.3% over the past 6 months but remains 4.4% higher than a year ago. This is also a seller’s market, with a sales-to-listings ratio of 50% and only a 4 month supply of homes for sale as of October.

New Westminster: After a severe slump in September, housing sales rallied 6% in October to a still low 71 transactions. This compares with average sales of more than 166 per month in the same month one and two years ago. The low sales are a bit of a puzzle. The Royal City has proved a magnet for Millennials and the composite home price, at $809,800, is the lowest in Greater Vancouver. Condos led October sales, with 58 transactions at a median of $575,000, about $100,000 less than in neighbouring Burnaby. The Royal City also has SkyTrain service, a riverfront esplanade and a central location in the region so we expect sales will increase. Right now, it is technically a seller’s market with just a 4 month supply of listings and a sales-to-listing ratio of 49%, based on a tight inventory of just 310 homes for sale. But those looking at location and value may decide the city offers an advantage to buyers.

Coquitlam: In October, Coquitlam had more condos for sale (186) than every Greater Vancouver market except Burnaby and Vancouver, a reflection of the SkyTrain-linked strata developments on the Burnaby border. Coquitlam’s condo sales-to-listing ratio is a strong 59% and the median condo price in October was $638,000, third highest in the region. The 56 detached house sales in October were down nearly 50% from a year earlier, but the benchmark price was up 5% in the same period to $1,750,400. Townhouses are benchmarked at more than $1 million. With a total inventory of 619 listings and 3 months supply of listings, this is a seller’s market and has been for quite some time.

Port Moody: Total residential sales, at 44 in October, have not been this low for the month since October of 2018 and active listings, at 179, were down from 187 in September 2022. The composite home price was down 2% from September, and 8.6% lower than six months earlier, at $1,117,500 in October. With a sales-to-listing ratio of 54%, however, and a slim inventory of just a 4 month supply, this remains a seller’s market.

Port Coquitlam: This is one of the least-expensive housing markets in Greater Vancouver and the city saw sales rally in October as transactions increased 24% from September to 62 sales. This was down 49% from a year earlier, however, and the benchmark composite price continued a six-month slide to land at $917,000 in October, the lowest price in the Tri-City region. Active listings were at 187 at month end compared to 190 at the end of September.

This is a seller’s market with only a 3 month inventory at the current sales pace. Buyers, though, may consider PoCo an affordable option.

Pitt Meadows: With a current composite home price of $818,700, this small town attracts value-seeking buyers, including young families. With prices down 11% from six months ago, it will continue to be a draw. October total sales were up 5% from September to 21 transactions, but the total inventory of listings, at 107, and steep 25% drop in new listings in October from a month earlier means supply is limited. There is a 5 month supply of homes available so buyers should start looking early in this affordable market.

Maple Ridge: The benchmark price of a Maple Ridge townhouse in October was $732,000, but first-time buyers and young families should not get discouraged. In a recent search we found 9 active townhouse listings under $500,000, including some priced under $450,000. We also found more than a dozen condo apartments listed at less than $350,000, though the benchmark condo price is $525,500. A total of 99 sales were posted in October, down 14% from September, and the total inventory is a healthy 592, about double what it was a year ago. With a 6 month supply of listings and composite home prices down 17% in the past 6 months, this is a balanced market that is tilting sharply to a buyer’s advantage.

Ladner: Ladner’s new multi-family construction this year is mostly subsidized rentals, which won’t ease the tight inventory of market housing. With just 91 total listings on the market and a sales-to-listing ratio of 57%, supply is running low. In October, 21 residential properties sold at a benchmark of $1,110,600, a price up 0.6% from September, the first month-over-month price increase in at least six months. The detached house benchmark price, at $1,354,900, is 12.5% lower than in May 2022 but nearly unchanged (up 1%) from a year ago. With a 4 month supply of homes available, this is a seller’s market where prices are balancing.

Tsawwassen: The red-hot Southlands community helped drive sales and prices of townhouses in the area higher this spring, but prices have eased since. The benchmark Tsawwassen townhouse price in October was $1,218,400, still higher than in Richmond, Burnaby and even East Vancouver, but down 9.4% compared to 6 months earlier, when multiple offers were still being seen. Total home sales in October reached 28, up 33% from a month earlier but down 56% from October 2021. Detached houses are selling for $1,536,100, down 10.8% over the past six months. This is considered a balanced market with a 7 month supply of listings and a sales-to-listing ratio of 45% as of October.

Surrey: October sales of all types of homes were down sharply in October compared to a year earlier: detached sales fell 64.5% to 129 transactions; townhouse sales were down 52% and condo apartment sales dropped by 49.4% to just 146 units. Prices have stabilized, however, virtually unchanged from a month earlier. Detached houses sold in October at a benchmark of $1,584,100, up 2% from a October 2021; 128 townhouses sold at a $828,100 benchmark; and the condo apartment price was up 11% from a year earlier at $527,700. Still, with a huge inventory of homes listed and sales down at least 50% from a year ago, there are deals to be had. For instance, there were 111 active detached-house listings in Surrey priced at $900,000 or less and 24 condo apartments listed at $275,000 or less as this Dexter report was put together.