Getting to Average?

Download November Sales and Listings Statistics All Regional

Download November Sales and Listings Statistics Houses Townhouses Condos

Highlights of the November 2024 report

Time for the Bank of Canada to cut rates again

Seasonal slowdown in sales and listings

Sales in November outpaced November 2022 and 2023

Sellers not giving up on the idea of being able to make a move

As the year winds down, the mantra continues – keep on cutting your rate Bank of Canada! With a 50-point cut in the Bank of Canada’s key lending rate in the rearview mirror, it’s time to look ahead to repeating that at the next policy meeting on December 11th. With a stagnant economy as indicated by low inflation, poor jobs numbers and a lagging GDP, the only gift to give Canadians this month is lower borrowing costs. The federal government didn’t help that cause by introducing a “GST Holiday” for two months effective December 14th which included alcoholic drinks, prepared foods, toys – and video games and Christmas trees. That along with a promised $250 cheque to annual income earners below $150,000 may only muddy the water on where inflation could go. Lower interest rates would serve Canadians far better in the long run than a cheaper Christmas tree!

There were 2,181 properties sold in Greater Vancouver in November, after 2,632 properties sold in October, 1,852 sold in September, 1,903 sold in August. Total sales in November were higher than the months of November over the last two years when elevated interest rates kept buyers on the sidelines. October was the peak of the fall market and even with the decline in interest rates, the second half of 2024 will slightly lag the first half for the number of homes sold. Surprising in some ways given lower rates should bring more buyers to the table, but likely a sign that spring markets tend to attract more activity, and this will likely mean the trajectory of the spring market in 2025 will be at higher pace compared to 2024. With the Bank of Canada’s final rate announcement for 2024 on December 11, this could set the stage for a bump in sales as 2025 begins. And with changes in mortgage rules that will help first time buyers and those that require insured mortgages, there’s a reason to be optimistic about the real estate market next year. And even more optimism for buyers that have more listings to choose from compared to previous years.

Sales in November were a 28% increase from the 1,702 properties sold last year and a 34% increase from the 1,625 sales in November 2022. There is more optimism in the market compared to where we were the last two years. Activity in the last few weeks of November waned slightly, perhaps due to economic uncertainty following the U.S. Elections and hints that interest rates may not come down as fast due to potential policy changes from the U.S. While November almost always lags October in sales totals, there was a slight sense of buyer and seller hesitation as the month came to an end. It appears that both seller and buyer activity tailed off as the month ended. But this may be short lived once we get into 2025. We may also be seeing the effect of buyers waiting for mortgage rule changes to take effect in December allowing for presale buyers to amortize their mortgage over 30 years and increasing the threshold for insured mortgages to $1.5M.

Sales in November were 13% below the 10-year average, while in October sales were 5% below the 10-year average, although still a significant improvement over the months prior where September sales were 26% below the 10-year average, August 26% below the 10-year average, July at 18% below the 10-year average and June at 24% below the 10-year average. The change in November was partly a seasonal adjustment but more indicative of a tumultuous November of elections, rhetoric and interest rate guessing. Overall, total sales for the year will be close to the number we saw in 2023, mostly likely slightly above. Not an all time low for Greater Vancouver by any stretch, but a sign that after almost three years, people will be on the move in the next few years.

In Greater Vancouver the number of new listings declined in November, largely due to seasonality. While higher than the last two years for the month of November, the total new listings in November were below 2020 and 2021. Many sellers were not giving up on the idea of being able to make a move and while some came to the market with the intention to sell, some sellers are still positioning themselves at prices above where buyers are willing to pay. We’ll see a number of those listings come off as we finish the year. With 3,784 new listings in November, this was a 31% decline from the number of new listings in October and a 10% increase from the number of new listings that came out in November 2023. This after seeing October 2024 generate 17% more new listings than October 2023.

The number of new listings in November were only 5% above the 10-year average after October was 20% above the 10-year average and September was 16% above. Sellers tend to be more reluctant to come on the market as we move through the final months of the year, but this November seemed to show a greater reluctance compared to the previous 7 months. With 1 month left in the year, there will be close to 60,000 new listings in Greater Vancouver for the year though. This is well above the 50,883 new listings that came out in 2023. Will this trend continue in 2025? Buyers certainly hope for that as they take advantage of lower interest rates. There may be upward pressure on home prices if we don’t see a similar pace in new listings when we move into 2025.

New listing activity won’t be helped by government legislation like the Federal Flipping tax, which came into effect in January 2023, and the provincial Flipping Tax which will start on January 1st, 2025. Both will restrict some listings from coming to market as sellers choose to hold onto properties. And with Statistics Canada showing the effects for properties being sold within one year having a minimal impact on the market, such policies are likely to create more confusion in a real estate market that is already overregulated with policy. According to a Financial Times article from December 2, 2024 “It turns out just a little over three per cent of residential properties sold in B.C. in 2021 were owned for less than a year before being resold. Not only is the prevalence of “flipped” sales low, but the economic profits generated by such transactions were negligible, suggesting that flippers are not walking away with exorbitant ill-gotten wealth.” Makes you wonder why such policies are necessary and how this will impact buyers who would prefer to purchase a property that has been renovated so they don’t have to. Transactions needlessly taken out of the market.

There were 13,245 active listings in Greater Vancouver at month end, compared to 14,477 at the end of October. With active listings reaching 14,932 in September, the decline will continue for the remainder of the year with total active listings finishing around 10,500 at the end of 2024 and start 2025. Active listings are only up 21% year over year after being up 46% year-over-year at the end of May.

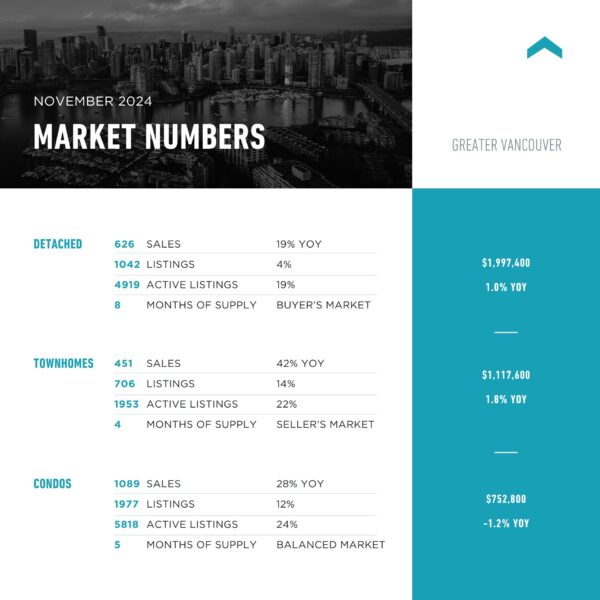

Months of supply overall stayed steady at 6 in Greater Vancouver. The detached market in Greater Vancouver is up to 8 months supply from 7 while townhomes stayed in the 4’s, inching closer to 3 (technically a seller’s market) and condos increased to 5 months supply from 4.5. The missing middle continues to be a challenge for buyers to get into due to limited product. And with housing starts on the decline, that will continue in the years to come. If you find the townhome you like, don’t wait to buy as prices for those types of homes will increase in the coming years. Last month townhomes and condos were sitting at 30% and 29% above last years’ active listing counts, this month they are at 22% and 24% respectively above last year’s active listings total. Meanwhile detached homes are at 19% above last year compared to October at 20% above the levels at that time in 2023.

Real estate sales in Metro Vancouver keep ebbing back and forth from average to below average. October showed a greater promise to get to an average market, with November falling back a little. With some push from a drop in the Bank of Canada rate this month, and less political distraction it’s entirely possible that the number of sales will push above the average in 2025 when pent up demand finally breaks free of the hesitation we’ve seen.

Here’s a summary of the numbers:

Greater Vancouver: Total Units Sold in November were 2,181 – down from 2,632 (17%) in October, up from 1,852 (18%) in September, up from 1,702 (28%) in November 2023, up from 1,625 (34%) in November 2022, down from 3,492 (38%) in November 2021, down from 3,131 (30%) in November 2020, and down from 2,546 (14%) in November 2019; Active Listings were at 13,245 at month end compared to 10,931 at that time last year (up 21%) and 14,477 at the end of October (down 9%); the 3,784 New Listings in November were down 31% compared to October 2024, up 10% compared to November 2023, up 20% compared to November 2022, down 6% compared to November 2021, down 9% compared to November 2020, and up 23% compared to November 2019. Month’s supply of total residential listings is steady at 6 month’s supply (balanced market conditions) and sales to listings ratio of 57% compared to 47% in October 2024, 49% in November 2023, and 52% in November 2022.

Month-over-month, the house price index is flat and in the last 6 months down 3.3%.

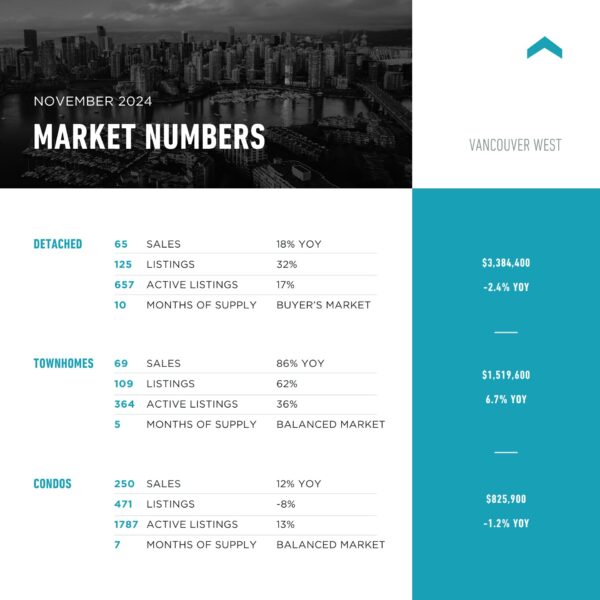

Vancouver Westside: Total Units Sold in November were 383 – down from 472 (21%) in October, up from 312 (23%) in September, up from 315 (22%) in November 2023, up from 306 (25%) in November 2022, down from 647 (41%) in November 2021, down from 470 (19%) in November 2020, and down from 406 (6%) in November 2019; Active Listings were at 2856 at month end compared to 2,432 at that time last year (up 17%) and 3,106 at the end of October (down 8%); the 710 New Listings in November were down 38% compared to October 2024, up 5% compared to November 2023, down 6% compared to November 2022, down 18% compared to November 2021, down 11% compared to November 2020, and up 25% compared to November 2019. Month’s supply of total residential listings is steady at 7 month’s supply (balanced market conditions) and sales to listings ratio of 53% compared to 41% in October 2024, 47% in November 2023, and 41% in November 2022.

Month-over-month, the house price index is up 1.1% and in the last 6 months down 2.3%.

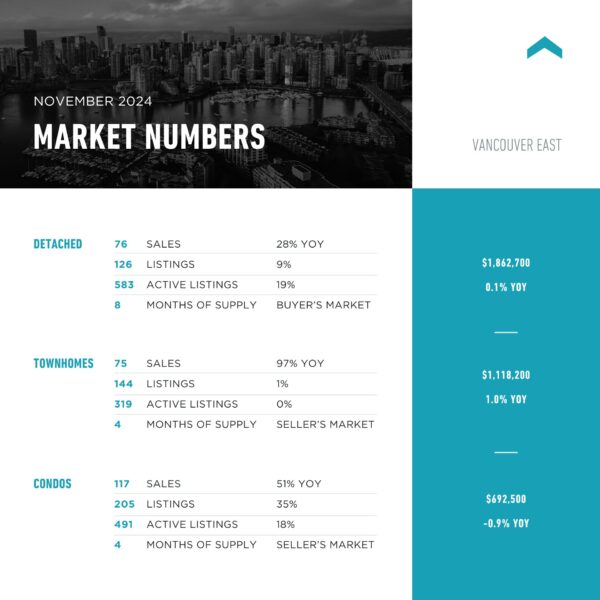

Vancouver East Side: Total Units Sold in November were 268 – down from 282 (5%) in October, up from 211 (27%) in September, up from 175 (53%) in November 2023, up from 167 (60%) in November 2022, down from 385 (30%) in November 2021, down from 364 (26%) in November 2020, and down from 310 (14%) in November 2019; Active Listings were at 1,407 at month end compared to 1,238 at that time last year (up 14%) and 1,512 at the end of October (down 7%); the 478 New Listings in November were down 22% compared to October 2024, up 17% compared to November 2023, up 44% compared to November 2022, down 6% compared to November 2021, the same compared to November 2020, and up 41% compared to November 2019. Month’s supply of total residential listings is steady at 5 month’s supply (balanced market conditions) and sales to listings ratio of 56% compared to 46% in October 2024, 43% in November 2023, and 50% in November 2022.

Month-over-month, the house price index is up down 0.7% and in the last 6 months down 1.6%.

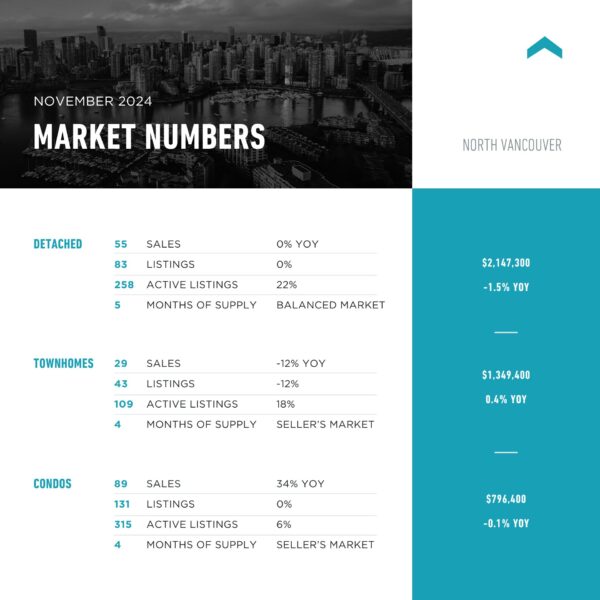

North Vancouver: Total Units Sold in November were 173 – down from 224 (23%) in October, up from 144 (20%) in September, up from 157 (10%) in November 2023, up from 149 (16%) in November 2022, down from 247 (30%) in November 2021, down from 264 (34%) in November 2020, and down from 217 (20%) in November 2019; Active Listings were at 716 at month end compared to 560 at that time last year (up 28%) and 848 at the end of October (down 16%); the 259 New Listings in November were down 47% compared to October 2024, down 3% compared to November 2023, down 0.5% compared to November 2022, down 32% compared to November 2021, down 23% compared to November 2020, and up 14% compared to November 2019. Month’s supply of total residential listings is steady at 4 month’s supply (seller’s market conditions) and sales to listings ratio of 66% compared to 46% in October 2024, 59% in November 2023, and 57% in November 2022.

Month-over-month, the house price index is up 0.6% and in the last 6 months down 5.6%.

West Vancouver: Total Units Sold in November were 45 – down from 59 (24%) in October, the same in September, down from 48 (6%) in November 2023, up from 28 (61%) in November 2022, down from 81 (44%) in November 2021, down from 90 (50%) in November 2020, and down from 66 (32%) in November 2019; Active Listings were at 645 at month end compared to 593 at that time last year (up 9%) and 707 at the end of October (down 9%); the 120 New Listings in November were down 44% compared to October 2024, down 15% compared to November 2023, up 6% compared to November 2022, up 3% compared to November 2021, up 6% compared to November 2020, and up 3% compared to November 2019. Month’s supply of total residential listings is up to 14 month’s supply from 12 (buyer’s market conditions) and sales to listings ratio of 37% compared to 28% in October 2024, 34% in November 2023, and 25% in November 2022.

Month-over-month, the house price index is down 0.4% but in the last 6 months down 5.5%.

Richmond: Total Units Sold in November were 234 – down from 290 (19%) in October, up from 197 (19%) in September, up from 179 (31%) in November 2023, up from 210 (11%) in November 2022, down from 481 (51%) in November 2021, down from 335 (30%) in November 2020, and down from 273 (14%) in November 2019; Active Listings were at 1,584 at month end compared to 1,258 at that time last year (up 26%) and 1,657 at the end of October (down 4%); the 469 New Listings in November were down 20% compared to October 2024, up 16% compared to November 2023, up 57% compared to November 2022, down 8% compared to November 2021, down 10% compared to November 2020, and up 22% compared to November 2019. Month’s supply of total residential listings is up to 7 month’s supply from 6 (balanced market conditions) and sales to listings ratio of 49% compared to 49% in October 2024, 44% in November 2023, and 70% in November 2022.

Month-over-month, the house price index is down 0.2% and in the last 6 months down 4.2%.

Burnaby East: Total Units Sold in November were 38 – up from 25 (52%) in October, up from 29 (31%) in September, up from 13 (192%) in November 2023, up from 14 (171%) in November 2022, up from 33 (15%) in November 2021, up from 37 (3%) in November 2020, and up from 33 (15%) in November 2019; Active Listings were at 144 at month end compared to 93 at that time last year (up 55%) and 158 at the end of October (down 9%); the 56 New Listings in November were down 19% compared to October 2024, up 87% compared to November 2023, up 51% compared to November 2022, up 44% compared to November 2021, down 47% compared to November 2020, and up 51% compared to November 2019. Month’s supply of total residential listings is down to 4 month’s supply from 6 (seller’s market conditions) and sales to listings ratio of 67% compared to 36% in October 2024, 43% in November 2023, and 38% in November 2022.

Month-over-month, the house price index is down 1.4% and in the last 6 months down 4.6%.

Burnaby North: Total Units Sold in November were 145 – down from 168 (14%) in October, up from 122 (19%) in September, up from 119 (22%) in November 2023, up from 92 (58%) in November 2022, down from 185 (22%) in November 2021, up from 156 (7%) in November 2020, and up from 137 (6%) in November 2019; Active Listings were at 729 at month end compared to 549 at that time last year (up 33%) and 791 at the end of October (down 8%); the 262 New Listings in November were down 11% compared to October 2024, up 40% compared to November 2023, up 63% compared to November 2022, up 20% compared to November 2021, up 6% compared to November 2020, and up 98% compared to November 2019. Month’s supply of total residential listings is steady at 5 month’s supply (balanced market conditions) and sales to listings ratio of 55% compared to 57% in October 2024, 64% in November 2023, and 57% in November 2022.

Month-over-month, the house price index is down 0.4% and in the last 6 months down 3.0%.

Burnaby South: Total Units Sold in November were 134 – down from 166 (19%) in October, up from 114 (18%) in September, up from 83 (61%) in November 2023, up from 118 (14%) in November 2022, down from 225 (40%) in November 2021, down from 159 (18%) in November 2020, and down from 167 (20%) in November 2019; Active Listings were at 597 at month end compared to 487 at that time last year (up 23%) and 675 at the end of October (down 12%); the 167 New Listings in November were down 41% compared to October 2024, up 1% compared to November 2023, down 4% compared to November 2022, down 25% compared to November 2021, down 18% compared to November 2020, and down 4% compared to November 2019. Month’s supply of total residential listings is steady at 4 month’s supply (seller’s market conditions) and sales to listings ratio of 80% compared to 58% in October 2024, 50% in November 2023, and 68% in November 2022.

Month-over-month, the house price index is up 0.1% and in the last 6 months down 3.3%.

New Westminster: Total Units Sold in November were 93 – down from 120 (22%) in October, up from 73 (27%) in September, up from 65 (43%) in November 2023, up from 65 (43%) in November 2022, down from 177 (47%) in November 2021, down from 137 (32%) in November 2020, and down from 123 (24%) in November 2019; Active Listings were at 464 at month end compared to 302 at that time last year (up 54%) and 480 at the end of October (down 3%); the 176 New Listings in November were down 31% compared to October 2024, up 34% compared to November 2023, up 38% compared to November 2022, down 2% compared to November 2021, up 5% compared to November 2020, and up 81% compared to November 2019. Month’s supply of total residential listings is up to 5 month’s supply from 4 (balanced market conditions) and sales to listings ratio of 52% compared to 47% in October 2024, 50% in November 2023, and 51% in November 2022.

Month-over-month, the house price index is down 0.9% and in the last 6 months down 3.5%.

Coquitlam: Total Units Sold in November were 172 – down from 246 (30%) in October, up from 155 (11%) in September, up from 159 (8%) in November 2023, up from 134 (28%) in November 2022, down from 289 (40%) in November 2021, down from 260 (34%) in November 2020, and down from 210 (18%) in November 2019; Active Listings were at 1,027 at month end compared to 721 at that time last year (up 42%) and 1,102 at the end of October (down 7%); the 314 New Listings in November were down 33% compared to October 2024, up 8% compared to November 2023, up 27% compared to November 2022, down 3% compared to November 2021, down 16% compared to November 2020, and up 45% compared to November 2019. Month’s supply of total residential listings is up to 6 month’s supply from 4 (balanced market conditions) and sales to listings ratio of 54% compared to 53% in October 2024, 55% in November 2023, and 54% in November 2022.

Month-over-month, the house price index is down 1.2% and in the last 6 months down 5.1%.

Port Moody: Total Units Sold in November were 63 – down from 66 (5%) in October, up from 61 (3%) in September, up from 40 (58%) in November 2023, up from 33 (91%) in November 2022, up from 61 (3%) in November 2021, down from 67 (6%) in November 2020, and up from 43 (47%) in November 2019; Active Listings were at 212 at month end compared to 166 at that time last year (up 28%) and 253 at the end of October (down 16%); the 80 New Listings in November were down 45% compared to October 2024, down 7% compared to November 2023, down 9% compared to November 2022, up 10% compared to November 2021, down 6% compared to November 2020, and up 67% compared to November 2019. Month’s supply of total residential listings is down to 3 month’s supply from 4 (seller’s market conditions) and sales to listings ratio of 78% compared to 45% in October 2024, 47% in November 2023, and 38% in November 2022.

Month-over-month, the house price index is down 0.4% and in the last 6 months down 3.6%.

Port Coquitlam: Total Units Sold in November were 76 – down from 77 (1%) in October, up from 52 (46%) in September, up from 55 (38%) in November 2023, up from 39 (95%) in November 2022, down from 127 (40%) in November 2021, down from 102 (25%) in November 2020, and down from 90 (16%) in November 2019; Active Listings were at 285 at month end compared to 183 at that time last year (up 56%) and 328 at the end of October (down 13%); the 109 New Listings in November were down 26% compared to October 2024, up 21% compared to November 2023, up 20% compared to November 2022, down 4% compared to November 2021, down 8% compared to November 2020, and down 11% compared to November 2019. Month’s supply of total residential listings is steady at 4 month’s supply (seller’s market conditions) and sales to listings ratio of 69% compared to 52% in October 2024, 61% in November 2023, and 43% in November 2022.

Month-over-month, the house price index is up 1.0% and in the last 6 months down 3.2%.

Pitt Meadows: Total Units Sold in November were 30 – down from 32 (6%) in October, up from 24 (25%) in September, up from 21 (42%) in November 2023, up from 22 (36%) in November 2022, down from 32 (6%) in November 2021, down from 46 (35%) in November 2020, and up from 24 (25%) in November 2019; Active Listings were at 105 at month end compared to 83 at that time last year (up 26%) and 121 at the end of October (down 13%); the 42 New Listings in November were down 26% compared to October 2024, up 7% compared to November 2023, up 50% compared to November 2022, down 5% compared to November 2021, up 11% compared to November 2020, and up 121% compared to November 2019. Month’s supply of total residential listings is steady at 4 month’s supply (seller’s market conditions) and sales to listings ratio of 71% compared to 56% in October 2024, 53% in November 2023, and 78% in November 2022

Month-over-month, the house price index is up 0.8% and in the last 6 months down 0.7%.

Maple Ridge: Total Units Sold in November were 116 – down from 143 (19%) in October, up from 114 (2%) in September, up from 103 (13%) in November 2023, up from 94 (23%) in November 2022, down from 198 (41%) in November 2021, down from 176 (34%) in November 2020, and down from 169 (31%) in November 2019; Active Listings were at 765 at month end compared to 718 at that time last year (up 6%) and 848 at the end of October (down 10%); the 219 New Listings in November were down 31% compared to October 2024, up 9% compared to November 2023, up 15% compared to November 2022, up 0.5% compared to November 2021, up 7% compared to November 2020, and up 2% compared to November 2019. Month’s supply of total residential listings is up to 7 month’s supply (balanced market conditions) and sales to listings ratio of 52% compared to 45% in October 2024, 51% in November 2023, and 49% in November 2022.

Month-over-month, the house price index is down 0.6% and in the last 6 months down 2.5%.

Ladner: Total Units Sold in November were 33 – up from 31 (6%) in October, up from 22 (50%) in September, up from 21 (57%) in November 2023, up from 16 (106%) in November 2022, down from 41 (20%) in November 2021, down from 47 (30%) in November 2020, and down from 42 (21%) in November 2019; Active Listings were at 135 at month end compared to 104 at that time last year (up 30%) and 142 at the end of October (down 5%); the 44 New Listings in November were down 28% compared to October 2024, up 69% compared to November 2023, up 91% compared to November 2022, up 10% compared to November 2021, up 16% compared to November 2020, and down 14% compared to November 2019. Month’s supply of total residential listings is down to 4 month’s supply from 5 (seller’s market conditions) and sales to listings ratio of 75% compared to 51% in October 2024, 81% in November 2023, and 70% in November 2022.

Month-over-month, the house price index is down 1.0% and in the last 6 months down 1.9%.

Tsawwassen: Total Units Sold in November were 26 – down from 36 (28%) in October, down from 34 (24%) in September, up from 20 (30%) in November 2023, down from 31 (16%) in November 2022, down from 52 (50%) in November 2021, down from 55 (53%) in November 2020, and down from 36 (28%) in November 2019; Active Listings were at 204 at month end compared to 180 at that time last year (up 13%) and 223 at the end of October (down 9%); the 44 New Listings in November were down 45% compared to October 2024, down 2% compared to November 2023, up 47% compared to November 2022, down 10% compared to November 2021, down 43% compared to November 2020, and the same compared to November 2019. Month’s supply of total residential listings is up to 8 month’s supply from 6 (buyer’s market conditions) and sales to listings ratio of 59% compared to 45% in October 2024, 44% in November 2023, and 103% in November 2022.

Month-over-month, the house price index is up 2.5% and in the last 6 months down 4.5%.

Fraser Valley: Sales in November were down 14.6%, compared to October and were up 27.5% from November 2023. New listings were down 25.9% from October and up 16.6% from November 2023.The average price was up 0.7% month-over-month and is up 2.7% year-over-year. Active listings were down 7.7% to 8,125 from 8,799 last month and up 29.9% from November 2023 which was at 6,254. Month’s supply of total residential listings is the same at 7 months (balanced market conditions).

“Buying and selling activity is typically quiet at this time of year,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “But it’s worth noting that November 2024 sales are higher than they’ve been compared to the past two Novembers – a sign that overall activity is picking up in the Fraser Valley and with it, growing buyer confidence.”

Month-over-month, the house price index is down 0.3% and in the last 6 months 3.7%.