Next half of 2023 may lack thrills of first six months

Download June Sales and Listings Statistics All Regional

Download June Sales and Listings Statistics Houses Townhouses Condos

Highlights of the Dexter Mid-Year 2023 Report

• Overall housing sales were 194% higher in June compared to January

• Composite home benchmark price is up 8% from the start of the year

• Record high prices are being seen in suburban markets

• Investors pile in as condo prices are nearing record highs

• Vancouver’s benchmark home price now higher than New York City

Fraser Valley housing sales are up 51.1% from June of 2022

The first six months of 2023 proved a thrill ride for Metro Vancouver home buyers and sellers, who switched reins at least three times and still managed to post a surprising pace of real estate transactions, with June sales up 194% from January 2023.

As sales and prices increased, 5,466 new listings joined the action. There were 9,990 properties for sale as June ended, the highest increase month-over-month since earlier in 2022. It was still not enough to satisfy June demand as nearly 3,000 homes were sold. We are still seeing multiple offers at a pace indicative of a true seller’s market. Despite back-to-back months of higher listings, the low inventory keeps buyers competing in most markets, even detached houses in some areas.

In June, the Bank of Canada threw up another interest rate hike to slow the market, but buyers rode right over it. June’s 2,988 total home sales surpassed June 2022 and both sales and prices blew past projections.

“The market continues to outperform expectations across all segments,” said Andrew Lis, REBGV’s director of economics and data analytics.

As they say, what a ride.

Condominium buyers, some of them investors, snapped up 1,573 apartments in June to lead the property trifecta: that was more sales than all the detached and townhome sales combined in the month. As Lis noted, “The benchmark price of a condo apartment is almost cresting the peak reached in 2022, while sales of apartments are now above the region’s 10-year seasonal average.”

Data from the Canadian Housing Statistics Program (CHSP) shows that 45.6% of Vancouver condos are owned by investors who hold at least three condo apartments. In some Fraser Valley markets, it is even higher.

The surprise, though, is not that so many people own multiple condos, but that more don’t. You don’t need to be a statistician to figure out why buyers are drawn to condominiums. In Greater Vancouver, the benchmark price of a condo apartment increased by $47,000 during the first six months of this year, to $767,000. In Abbotsford, which led the province with multiple owners accounting for nearly 70% of the condo investment market, the average apartment price in June was $16,000 higher than in January 2023.

With the highest rental rates in the country – a one-bedroom condo rents in Metro Vancouver for an average of $2,700 a month and can easily top $3,000 – investors with enough equity can achieve positive cash flow as they watch the condo appreciate. Thanks to new provincial regulations, virtually all condos are now rental allowable units since the province outlawed strata rental restrictions, except for a strata still being able to have an age restriction of 55-plus. Even in those, an older tenant can still be welcomed.

Condominiums of course remain the most affordable option as first-time buyers deal with higher mortgage rates and a mortgage stress test rate of 5.25%. The detached-house benchmark is now $1,991,300 and is rising by nearly 2% per month. Scarce townhouses sold in June at a benchmark of $1,098,000, up 9% compared to the first of the year.

The Bank of Canada’s nine interest rate hikes were meant to stall housing sales, and they certainly did. In June 2023, the latest rate hike helped drive detached house sales down 19% from a month earlier, but the median price had already increased about $180,000 compared to January.

To add fuel to the inflationary fire, retail spending in B.C. is now running at a near-record high of $8.9 billion a month.

This all points to another Bank of Canada rate hike on July 12. While inflation hit a low in the recent report in June, today’s jobs number for Canada give the Bank of Canada fuel to increase their rate. They really shouldn’t, but quite possibly will. Further adding costs to Canadians at a time when it can least be afforded. Can this market withstand a 5% or 5.50% prime rate and a mortgage rate above 7%? We are about to find out as this fast-paced real estate year heads into the second half.

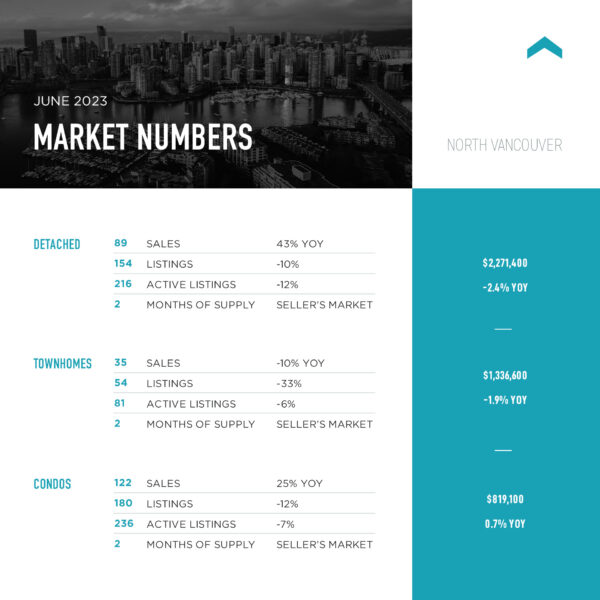

Regional market numbers:

Greater Vancouver: There was only a three-month supply of total listings on the market in June and a benchmark price of $1,203,000, which was up 8.5% from the start of the year. (As a reality check, the comparable benchmark price in New York City is US$829,000, or $1.12 million Canadian.) Townhomes continue to be the least available home in the market, and that will continue to be that theme for years to come. In the first quarter of this year, only 112 new townhouses started construction. It is not a priority of city planners and there is no creativity to densify with townhouses, be it a strata or the rare freehold row homes. With the price of land so high in Vancouver, the cost of construction at record levels and municipal development fees increasing, developers are forced to build to the maximum density allowed to reach any relative level of affordability. Active listings flirted with 10,000 during the month but finished at 9,990. June’s overall sales-to-listing ratio was 55%, down from 59% in May but still showed strength considering the bump up in fixed and variable rates.

Fraser Valley: June housing sales rocketed past all projections, soaring 51.1% from June 2022 to 1,953 transactions, which was also up 13% from May 2023. But new listings were down 3% from May and off 2.8% from a year earlier.” Prices continue to trend upward, with lack of supply and high demand for housing,” noted Narinder Bains, chair of the Fraser Valley Real Estate Board. While prices were down marginally from June 2022, they continue to increase this year. The June detached house benchmark was $1,526,600, up 2.3% from May; townhouse prices increased the same amount to $845,400; and the condo apartment benchmark was up 1.8% month-over-month at $552,200.

Vancouver Westside: Just 75 detached houses sold in June, down from 109 in May but up from 71 in June 2022, while the benchmark price was $3,418,700, 9.9% higher than in January and 2.4% above May 2023, but down 3.2% from June 2022. Townhomes and condos are still in seller’s market conditions. There were only 130 new listings for townhomes in May and 62 of them sold, for a 48% sales success ratio at a benchmark price of $1,497,000, a record price that is 2.7% higher than in June 2022 and nearly $180,000 higher than in January 2023. Condos dominated sales, with 390 transactions, a sales-to-listing ratio of 50% and a benchmark price of $856,000, also a record high, and up nearly 7% from the start of the year.

Vancouver East: The June benchmark price of a detached house in Vancouver East, at $1,879,700 was 31% higher than pre-pandemic 2019 and 9.6% higher than in January 2023. That is an increase of more than $180,000 in six months. The detached sales ratio is running at 43%, signaling a moderate seller’s market. Townhomes are deep into a seller’s market, with a sales-to-listing ratio of 61% and a benchmark price up nearly 8% from six months earlier, at $1,108,900. Good news for buyers is that townhome prices have remained nearly unchanged from three months ago. The June benchmark condo price, however, set a record in June of $856,000, up 1.2% from a year ago and 7% higher than in January 2023. In the first half, 696 condos were sold in Vancouver East, compared to 1,058 in the same period last year. Currently, the sales-to-listing ratio is 58% in this seller’s arena.

North Vancouver: With just a 2-month supply of total listings, and a sales-to-listing ratio of 68%, this is a strong seller’s market. New listings were down in all property types compared to May while the benchmark home price is the second highest in the region, at $1,409,100, a price up 8.6% from six months ago, though still 2% below June 2022.

West Vancouver: If they can handle the prices, buyers are in control of West Vancouver’s detached-house sector, where the median price in June was $3,418,000, up more than $500,000 from a month earlier, though sales dipped to 28 transactions, down from 41 in May 2023. There is a 15-month supply of houses, with sales at the lowest level in five months. Townhome listings are disappearing: 5 new listings in June and 6 sales. The June benchmark condo price was $1,339,700, a record high, even with a relatively low sales ratio of 37%.

Richmond: With a lack of listings and a sales ratio of 57% across the board, Richmond is a seller’s market that is testing a new record high for prices. The benchmark price in June was $1,185,500, nearly matched with June of 2022 and 9% higher than in January 2023. In June, 95 detached houses sold at a benchmark of $2,182,000, up 10% from six months ago. Condo sales reached 192 units, even a month earlier, but the benchmark price was down 1% ,month-to-month at $739,800.

Burnaby East: A severe shortage of listings combined with a 73% sales-to-listing ratio is driving all prices higher. June detached house sales doubled from May 2023 even as benchmark prices hit a record high of $1,912,200 – and that was still the lowest detached price in Burnaby for the month. Mark this a seller’s market on steroids with the composite home price up 9% from the first of the year, and the strata market averaging an 83% sales success ratio with just a 2-month supply of listings.

Burnaby North: Despite the Amazing Brentwood, Gilmore and Lougheed building booms over the past few years, there is still a shortage of strata homes for sale. Townhomes, for instance, are seeing a 93% sales-to-listing ratio and June benchmark townhouse price was $903,500, up 6.7% from January 2023. Condo apartments sold at a benchmark of $753,800, the highest price on record. Still strata prices are far below detached houses, which reached $2,039,400 in June, up 2.9% from a month earlier.

Burnaby South: This is also a seller’s market, with just a 3-month supply of listings based on current sales level. The overall sales-to-listing ratio is a robust 61%, led by condos, where 70% of new listings sold in June at a benchmark price of $812,100. A crack in the seller’s advantage is the detached house sector, with a more modest 39% sales success ratio, but the detached benchmark is $2,213,200, up 9.5% so far this year.

New Westminster: Multiple bids are now common in New Westminster, with both detached and townhomes selling for more than the list price. Not a surprise with just a 2-month supply of total listings and a total of only 40 new non-rental housing starts so far this year in the entire municipality. The benchmark townhome price in June was $945,100, up 7.2% from January 2023, while condos are selling at a record benchmark of $653,400. Detached houses were also at a record high in June of $1,570,600, up 11.6% (yes, more than $158,000) from benchmark at the start of 2023.

Coquitlam: One must wonder if supply is the answer to affordability when one looks at Coquitlam, which has been characterized by construction cranes for years. There was only a 2-month supply of strata homes on the June market and prices skyrocketed. The condo benchmark is now at an all-time high of $737,500 and is rising by 1.3% per month this year, with a sales ratio of 70%. The overall sales-to-listing ratio is 61%, which is eating into the tight supply.

Detached-house benchmarks hit a record high of $1,787,000 in June and there is just a 3-month supply of houses listed.

Port Moody: 100% of the condos listed for sale sold in June, to give an idea of the tight supply in a market blessed with SkyTrain service but cursed with a low housing starts for years. Big new strata projects are in play but still two years away from completion. June total sales were higher than in June 2021, which was the former market peak. Townhomes are selling at just over $1 million, and the benchmark condo apartment price is $728,000, 7.2% higher than in January.

June saw 21 detached houses sell at a benchmark of $2,035,000, up 1.4% from May 2023 but 7% below June 2022.

Port Coquitlam: There is a 2-month supply overall with a 65% absorption rate, but only a 1-month supply of townhomes and condos with sales ratios of 78% and 73%, respectively. The June benchmark home price, at $967,900 is up 9.2% from the first of the year, and down just 1.3% from June 2022. This is a tight seller’s market.

Pitt Meadows: This market was very popular during the COVID period and has come back into fashion this year. In June, the detached sales-to-listing ratio was 100% and the benchmark price for a detached house has soared 13.8% so far this year – the highest increase in Metro Vancouver – to $1,319,000. There were only 12 active townhouse listings and 14 condo active listings at month end.

Maple Ridge: With the composite home price rising 9.4% since January to reach $997,900, the overall market has just a 3-month supply with strata listings down to only a 2-month inventory.

New listings are taking up a sales ratio of 56% in this seller’s market.

Ladner: Ladner saw the first price drop in the townhome benchmark price when it dipped a mere 0.2% from May to June’s $971,700, a price up 13.5% from January to mark the highest six-month townhouse price rise in the Metro region. There were just 11 active townhome listings at the end of June, and just 7 total condo listings. Meanwhile, the detached house benchmark was $1,422,900, up 10% from January and 14.2% higher than at the end of the first quarter.

This is a seller’s market with price momentum and a sales-to-listing ratio of 62%.

Tsawwassen: This is a more balanced market in the detached-house sector, with about a 5-month supply of listings. The benchmark detached price in June was $1,596,700, up 10.8% since January at sales-to-listing ratio of 62%. Townhouse benchmarks are at $999,600, up 10.3% compared to January, and the condo benchmark in June was $690,700, 7% higher than when this year started. Strata listings are at a 3-month supply, based on current sales.