Jump Start to the Real Estate Market

Download Jan Sales and Listings Statistics All Regional

Download Jan Sales and Listings Statistics Houses Townhouses Condos

Highlights of Dexter’s January 2024 report

- Buyers are back! Sales in Greater Vancouver were up 39% from January 2023

- Vancouver detached listings are at the lowest level since December 2015

- The number of new listings were only up 15% from January 2023

- When will the Bank of Canada cut its rate?

- The total number of sales in West Vancouver were the lowest by month since 2008

A new year, a new real estate market. Sort of. As 2024 took hold, buyers appeared to embrace homebuying more so than they did when 2023 began. Sales were up 39% in Greater Vancouver and 52% in the Fraser Valley year-over-year. Anticipation of future rate cuts were on the minds of many as they awaited the Bank of Canada’s first interest rate announcement in late January. While a rate cut wasn’t anticipated, the messaging of future rate cuts was on the minds of many. And while some predicted the next Bank of Canada meetings in March and April could be the first rate cut since the spate of increases starting in 2022, sticky inflation and a Canadian economy sidestepping a recession could keep the current Bank rate in check until June or July. Buyers don’t seem to want to wait though as market activity so far is indicating the pent-up demand can only hold off for so long.

There were 1,427 properties sold in Greater Vancouver in January this year. This was a 39% increase from the 1,030 properties sold last year in January. And this was the first month-over-month increase in sales since May of last year. You can only keep a good market down for so long. Even with the deep freeze and snow event last month, buyers made their way out to go through the limited supply of listings, many surprised at how many were no longer available. As the temperature in January rose to finish the month, the real estate market seemed to see its temperature rise as well. Will February produce the first month with more than 2,000 sales since August? Likely yes, but that will require a few more sellers to join jump into the market as well. With this increase in activity, sales in January were 22% below the 10-year average after sales in December were 37% below the 10-year average and November’s sales were at 35% below the 10-year average. The trends and numbers certainly show an increase in buyer activity. The stats don’t lie.

With current sales, we continue to be in a balanced market with 6 months supply of homes overall in Greater Vancouver, falling back from 7 months supply in December. Vancouver’s West Side was higher in the region at 8 months supply and West Vancouver with its lowest monthly sales since December 2008 clocked in at 21 months supply of homes available. A severe buyer’s market. While its neighbour next door, North Vancouver, maintained its 4 months supply, doing its best seller’s market imitation. Burnaby North and South, New Westminster, Port Coquitlam, and Ladner all finished January with 4 months supply of listings. Ladner didn’t see any condo sales in January, but then again there are only 8 active listings and there were no new listings in December, proving you can’t buy what isn’t available. Pitt Meadows has the lowest supply in the region with only 3 months worth of listings available for buyers shopping in that city.

With the precipitous drop in total listings we saw through the last two months of 2023, January saw 3,875 new listings. This was the third lowest number of new listings for the month of January since the year 2000. This after there were only 1,355 new listings in December after 3,440 new listings in November, but it was slightly higher than the number of new listings in January last year at 3,384.

The number of new listings in January were 13% below the 10-year average, which is an improvement from December with the number of new listings in that month being 25% below the 10-year average. But still below the averages in the 3 months preceding December: 3% below the 10-year average in November, 5% above the 10-year average in October and 6% above the 10-year average in September.

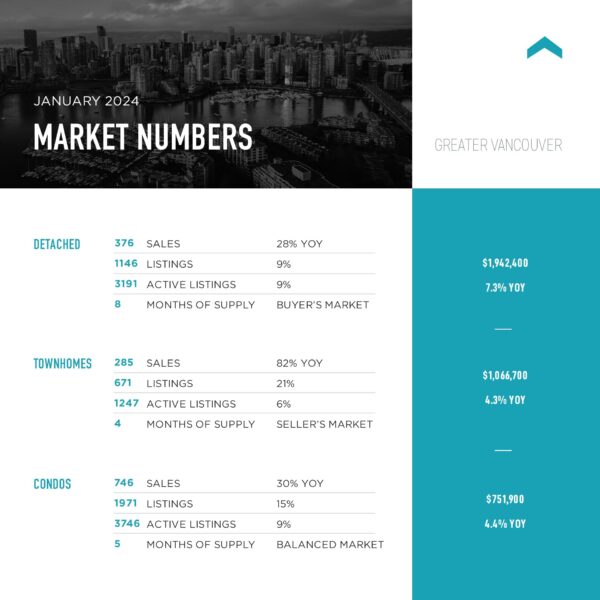

There were 8,633 active listings in Greater Vancouver at the end of January after seeing 8,802 active listings at the end of December. It’s rare to see the total number of active listings end with less in January then in December, but after several listings expired at the end of December, January started with 7,828 active listings. And with fewer new listings in January than is typical, that hole is hard to dig out of. Perhaps it’s a signal to sellers that the opportunity to list their home on the market is better than we’ve seen over the last year. Buyers are shopping and hoping that more sellers will list. The detached market overall remains in buyer’s market territory with 8 months supply of inventory, down from 9 months in December. Townhomes slipped down to 4 months supply and condos continue to sit just above 5 months supply of listings. The missing middle known as townhomes had a 42% absorption rate in January with sales up 82% compared to January last year. This was higher than detached at 33% absorption and sales 28% higher than January 2023 and condos at 37% absorption and sales 30% higher than January 2023. Perhaps the provincial government’s small-scale, multi-unit housing plan should have focused more on building more townhomes and row homes than 3 to 6 unit buildings scattered throughout the region.

As we start February, Ground Hogs in Canada indicated that we would see an early spring. Will we also see and early real estate market? The thought was it would depend on interest rates starting their decline, but with a little more uncertainty when that might happen, buyers seem to be wanting to get on finding their first or next home.

January was an indication that buyers are back, but the question remains – where are the sellers? A slower decline in interest rates may produce a more balanced market, as long we see more listings come on the market. The sudden rise in interest rates is keeping supply out of the real estate market, not just resale, but the much-needed new product that will fuel buyers in the years to come. Bank of Canada governor Tiff Macklem recently said that high-interest rates aren’t to blame for the housing crisis and that it can’t solve the housing crisis with interest rates. That seems to fly in the face of that fact that elevated interest rates are keeping new development at bay as higher interest rates add to the cost of housing and risk for developers. The extension of the Foreign Buyer ban announced on February 4, which will be until 2027 may also limit supply and not provide more. The host of government regulations have not helped to build more supply in the real estate market and is doing the opposite.

Here’s a summary of the numbers:

Greater Vancouver: Total Units Sold in January were 1,427 – up from 1,345 (6%) in December, down from 1,702 (16%) in November 2023, up from 1,030 (39%) in January 2023, down from 2,329 (39%) in January 2022, down from 2,454 (42%) in January 2021, down from 1,602 (11%) in January 2020, up from 1,102 (29%) in January 2019; Active Listings were at 8,633 at month end compared to 7,862 at that time last year and 8,802 at the end of December; New Listings in January were up 186% compared to December 2023, up 13% compared to November 2023, up 15% compared to January 2023, down 9% compared to January 2022, down 16% compared to January 2021, down 3% compared to January 2020, down 22% compared to January 2019. Month’s supply of total residential listings is down to 6 month’s supply (balanced market conditions) and sales to listings ratio of 37% compared to 99% in December 2023, 30% in January 2023 and 55% in January 2022. Month-over-month, the house price index is down 0.6% and in the last 6 months down 4.6%.

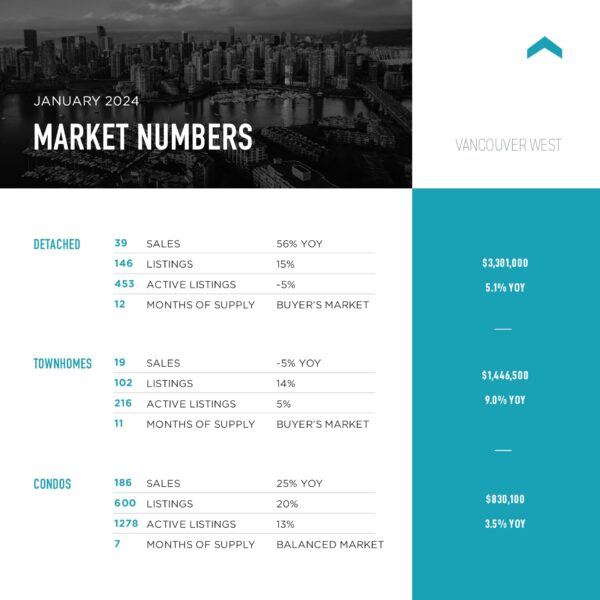

Vancouver Westside: Total Units Sold in January were 245 – up from 235 (4%) in December, down from 315 (23%) in November 2023, up from 194 (26%) in January 2023, down from 445 (45%) in January 2022, down from 393 (38%) in January 2021, down from 275 (11%) in January 2020, up from 187 (31%) in January 2019; Active Listings were at 1,963 at month end compared to 1,827 at that time last year and 1,998 at the end of December (detached listings at 453 were the lowest amount since December 2015); New Listings in January were up 244% compared to December 2023, up 26% compared to November 2023, up 18% compared to January 2023, down 16% compared to January 2022, down 5% compared to January 2021, up 15% compared to January 2020, down 13% compared to January 2019. Month’s supply of total residential listings is down to 8 month’s supply (buyer’s market conditions) and sales to listings ratio of 29% compared to 95% in December 2023, 27% in January 2023 and 44% in January 2022. Month-over-month, the house price index is down 0.9% and in the last 6 months down 4.8%.

Vancouver East Side: Total Units Sold in January were 164 – up from 148 (11%) in December, down from 175 (6%) in November 2023, up from 118 (39%) in January 2023, down from 257 (36%) in January 2022, down from 257 (36%) in January 2021, up from 161 (2%) in January 2020, up from 105 (56%) in January 2019; Active Listings were at 990 at month end compared to 867 at that time last year and 977 at the end of December; New Listings in January were up 240% compared to December 2023, up 23% compared to November 2023, up 40% compared to January 2023, up 5% compared to January 2022, down 2% compared to January 2021, up 40% compared to January 2020, up 10% compared to January 2019. Month’s supply of total residential listings is down to 6 month’s supply (balanced market conditions) and sales to listings ratio of 33% compared to 100% in December 2023, 33% in January 2023 and 54% in January 2022. Month-over-month, the house price index is down 0.6% and in the last 6 months down 3.5%.

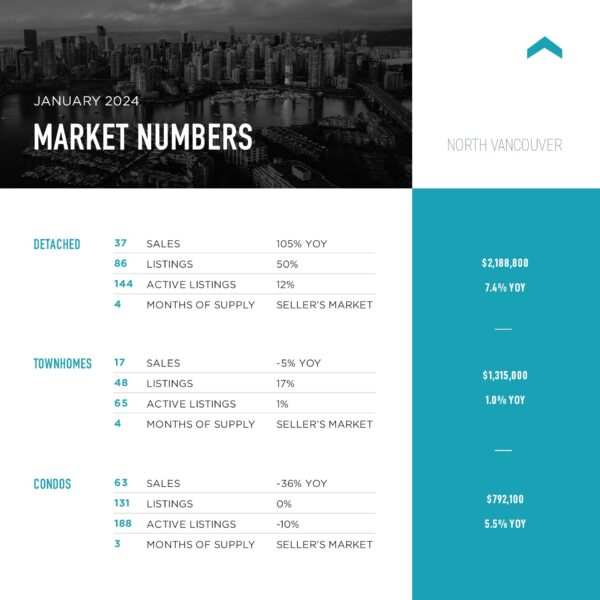

North Vancouver: Total Units Sold in January were 117 – up from 106 (10%) in December, down from 157 (25%) in November 2023, up from 82 (43%) in January 2023, down from 143 (19%) in January 2022, down from 179 (35%) in January 2021, up from 100 (17%) in January 2020, up from 91 (29%) in January 2019; Active Listings were at 414 at month end compared to 416 at that time last year and 392 at the end of December; New Listings in January were up 171% compared to December 2023, up 1% compared to November 2023, up 17% compared to January 2023, up 3% compared to January 2022, down 20% compared to January 2021, down 27% compared to January 2020, down 38% compared to January 2019. Month’s supply of total residential listings is steady at 4 month’s supply (seller’s market conditions) and sales to listings ratio of 43% compared to 106% in December 2023, 35% in January 2023 and 55% in January 2022. Month-over-month, the house price index is down 1.1% and in the last 6 months down 4.3%.

West Vancouver: West Vancouver saw the house price index increase 2.5% last month, but that will likely drop over the next month as sales stall in one of the highest priced neighbourhoods in the region.

Total Units Sold in January were 23 – down from 41 (44%) in December, down from 48 (52%) in November 2023, down from 28 (18%) in January 2023, down from 45 (49%) in January 2022, down from 45 (49%) in January 2021, down from 29 (21%) in January 2020, down from 26 (12%) in January 2019; Active Listings were at 483 at month end compared to 408 at that time last year and 487 at the end of December; New Listings in January were up 233% compared to December 2023, up 7% compared to November 2023, up 42% compared to January 2023, up 28% compared to January 2022, down 7% compared to January 2021, the same amount compared to January 2020, down 22% compared to January 2019. Month’s supply of total residential listings is up to 21 month’s supply (buyer’s market conditions) and sales to listings ratio of 13% compared to 76% in December 2023, 22% in January 2023 and 32% in January 2022.

Richmond: Total Units Sold in January were 161 – down from 169 (5%) in December, down from 179 (10%) in November 2023, up from 120 (34%) in January 2023, down from 340 (53%) in January 2022, down from 277 (42%) in January 2021, down from 227 (29%) in January 2020, up from 121 (33%) in January 2019; Active Listings were at 1,014 at month end compared to 942 at that time last year and 1,043 at the end of December; New Listings in January were up 154% compared to December 2023, up 2% compared to November 2023, up 1% compared to January 2023, down 26% compared to January 2022, down 31% compared to January 2021, down 22% compared to January 2020, down 46% compared to January 2019. Month’s supply of total residential listings is steady at 6 month’s supply (balanced market conditions) and sales to listings ratio of 39% compared to 104% in December 2023, 29% in January 2023 and 61% in January 2022. Month-over-month, the house price index is down 1.1% and in the last 6 months down 4.0%.

Burnaby East: Total Units Sold in January were 17 – down from 18 (6%) in December, up from 13 (31%) in November 2023, up from 9 (89%) in January 2023, down from 25 (32%) in January 2022, down from 28 (39%) in January 2021, down from 18 (6%) in January 2020, up from 11 (45%) in January 2019; Active Listings were at 77 at month end compared to 87 at that time last year and 75 at the end of December; New Listings in January were up 316% compared to December 2023, up 67% compared to November 2023, up 14% compared to January 2023, up 43% compared to January 2022, up 16% compared to January 2021, up 11% compared to January 2020, down 9% compared to January 2019. Month’s supply of total residential listings is up to 5 month’s supply (balanced market conditions) and sales to listings ratio of 34% compared to 150% in December 2023, 20% in January 2023 and 71% in January 2022. One of the few areas to see sales decline in January compared to December. Month-over-month, the house price index is up 0.3% and in the last 6 months down 3.5%.

Burnaby North: Total Units Sold in January were 88 – down from 91 (3%) in December, down from 119 (26%) in November 2023, up from 63 (40%) in January 2023, down from 142 (39%) in January 2022, down from 144 (39%) in January 2021, down from 96 (8%) in January 2020, up from 65 (3%5) in January 2019; Active Listings were at 387 at month end compared to 389 at that time last year and 417 at the end of December; New Listings in January were up 137% compared to December 2023, down 1% compared to November 2023, down 8% compared to January 2023, down 23% compared to January 2022, down 24% compared to January 2021, down 12% compared to January 2020, down 15% compared to January 2019. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 48% compared to 117% in December 2023, 31% in January 2023 and 60% in January 2022. Month-over-month, the house price index is down 0.8% and in the last 6 months down 3.5%.

Burnaby South: Total Units Sold in January were 102 – up from 79 (29%) in December, up from 83 (23%) in November 2023, up from 54 (89%) in January 2023, down from 150 (32%) in January 2022, down from 144 (29%) in January 2021, up from 90 (13%) in January 2020, up from 55 (85%) in January 2019; Active Listings were at 398 at month end compared to 352 at that time last year and 395 at the end of December; New Listings in January were up 185% compared to December 2023, up 29% compared to November 2023, up 32% compared to January 2023, down 12% compared to January 2022, down 18% compared to January 2021, up 2% compared to January 2020, down 24% compared to January 2019. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 48% compared to 105% in December 2023, 33% in January 2023 and 62% in January 2022. Month-over-month, the house price index is down 0.1% and in the last 6 months down 3.4%.

New Westminster: Total Units Sold in January were 54 – up from 46 (17%) in December, down from 65 (17%) in November 2023, up from 40 (35%) in January 2023, down from 102 (47%) in January 2022, down from 101 (47%) in January 2021, up from 50 (8%) in January 2020, down from 75 (28%) in January 2019; Active Listings were at 242 at month end compared to 220 at that time last year and 240 at the end of December; New Listings in January were up 244% compared to December 2023, up 2% compared to November 2023, up 26% compared to January 2023, down 10% compared to January 2022, down 37% compared to January 2021, down 6% compared to January 2020, down 32% compared to January 2019. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 40% compared to 118% in December 2023, 38% in January 2023 and 61% in January 2022. Month-over-month, the house price index is down 0.1% and in the last 6 months down 3.7%.

Coquitlam: Total Units Sold in January were 112 – down from 119 (6%) in December, down from 159 (30%) in November 2023, up from 73 (47%) in January 2023, down from 174 (36%) in January 2022, down from 225 (50%) in January 2021, down from 144 (22%) in January 2020, up from 87 (29%) in January 2019; Active Listings were at 521 at month end compared to 481 at that time last year and 527 at the end of December; New Listings in January were up 234% compared to December 2023, down 1% compared to November 2023, up 9% compared to January 2023, up 9% compared to January 2022, down 16% compared to January 2021, down 7% compared to January 2020, down 23% compared to January 2019. Month’s supply of total residential listings is up to 5 month’s supply (balanced market conditions) and sales to listings ratio of 39% compared to 138% in December 2023, 28% in January 2023 and 66% in January 2022. Month-over-month, the house price index is down 0.7% and in the last 6 months down 4.2%.

Port Moody: Total Units Sold in January were 31 – up from 25 (24%) in December, down from 40 (22%) in November 2023, up from 23 (35%) in January 2023, down from 57 (46%) in January 2022, down from 46 (33%) in January 2021, down from 37 (16%) in January 2020, the same as January 2019; Active Listings were at 122 at month end compared to 188 at that time last year and 128 at the end of December; New Listings in January were up 75% compared to December 2023, up 35% compared to November 2023, down 46% compared to January 2023, down 30% compared to January 2022, down 26% compared to January 2021, down 14% compared to January 2020, down 33% compared to January 2019. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 55% compared to 78% in December 2023, 22% in January 2023 and 71% in January 2022. Month-over-month, the house price index is down 2.3% and in the last 6 months down 2.5%.

Port Coquitlam: Total Units Sold in January were 43 – up from 36 (19%) in December, down from 55 (22%) in November 2023, up from 34 (26%) in January 2023, down from 77 (24%) in January 2022, down from 88 (51%) in January 2021, down from 60 (28%) in January 2020, up from 38 (13%) in January 2019; Active Listings were at 155 at month end compared to 123 at that time last year and 154 at the end of December; New Listings in January were up 87% compared to December 2023, down 19% compared to November 2023, down 6% compared to January 2023, down 30% compared to January 2022, down 54% compared to January 2021, down 43% compared to January 2020, down 49% compared to January 2019. Month’s supply of total residential listings is steady at 4 month’s supply (seller’s market conditions) and sales to listings ratio of 59% compared to 92% in December 2023, 44% in January 2023 and 73% in January 2022. Month-over-month, the house price index is down 0.4% and in the last 6 months down 4.7%.

Pitt Meadows: Total Units Sold in January were 20 – up from 19 (5%) in December, down from 21 (5%) in November 2023, up from 15 (33%) in January 2023, down from 30 (33%) in January 2022, down from 22 (9%) in January 2021, up from 19 (5%) in January 2020, up from 10 (29%) in January 2019; Active Listings were at 57 at month end compared to 61 at that time last year and 59 at the end of December; New Listings in January were up 171% compared to December 2023, down 3% compared to November 2023, the same as January 2023, down 7% compared to January 2022, up 23% compared to January 2021, down 25% compared to January 2020, down 3% compared to January 2019. Month’s supply of total residential listings is the same at 3 month’s supply (seller’s market conditions) and sales to listings ratio of 52% compared to 135% in December 2023, 39% in January 2023 and 73% in January 2022. Month-over-month, the house price index is up 1.6% and in the last 6 months down 4.5%.

Maple Ridge: Total Units Sold in January were 106 – up from 100 (6%) in December, up from 103 (3%) in November 2023, up from 65 (63%) in January 2023, down from 124 (15%) in January 2022, down from 194 (45%) in January 2021, down from 120 (12%) in January 2020, up from 82 (30%) in January 2019; Active Listings were at 563 at month end compared to 451 at that time last year and 579 at the end of December; New Listings in January were up 155% compared to December 2023, up 30% compared to November 2023, up 20% compared to January 2023, up 9% compared to January 2022, up 4% compared to January 2021, up 18% compared to January 2020, up 4% compared to January 2019. Month’s supply of total residential listings is down to 5 month’s supply (balanced market conditions) and sales to listings ratio of 40% compared to 98% in December 2023, 30% in January 2023 and 51% in January 2022. Month-over-month, the house price index is down 0.4% and in the last 6 months down 4.6%.

Ladner: Total Units Sold in January were 21 – up from 12 (75%) in December, the same as November 2023, up from 16 (31%) in January 2023, down from 22 (5%) in January 2022, up from 20 (5%) in January 2021, down from 35 (40%) in January 2020, up from 16 (31%) in January 2019; Active Listings were at 83 at month end compared to 81 at that time last year and 86 at the end of December; New Listings in January were up 229% compared to December 2023, up 77% compared to November 2023, up 7% compared to January 2023, down 28% compared to January 2022, down 12% compared to January 2021, down 37% compared to January 2020, down 26% compared to January 2019. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 46% compared to 86% in December 2023, 37% in January 2023 and 61% in January 2022. Month-over-month, the house price index is down 0.5% and in the last 6 months down 5.6%.

Tsawwassen: Total Units Sold in January were 24 – up from 21 (14%) in December, down from 27 (11%) in November 2023, up from 20 (20%) in January 2023, down from 42 (43%) in January 2022, down from 54 (56%) in January 2021, up from 21 (14%) in January 2020, up from 14 (71%) in January 2019; Active Listings were at 139 at month end compared to 137 at that time last year and 152 at the end of December; New Listings in January were up 183% compared to December 2023, up 13% compared to November 2023, down 11% compared to January 2023, down 35% compared to January 2022, down 43% compared to January 2021, down 27% compared to January 2020, down 30% compared to January 2019. Month’s supply of total residential listings is down to 6 month’s supply (balanced market conditions) and sales to listings ratio of 47% compared to 117% in December 2023, 35% in January 2023 and 54% in January 2022. Month-over-month, the house price index is down 1.2% and in the last 6 months down 2.6%.

Fraser Valley: Sales in December were up 16% from December but up 52% from January 2023. New listings were up 163% from December and up 30% from January 2023. While the average price was up 4.4% month-over-month, it is up 13% year-over-year. Active listings were down 4% to 4,132 from 4,302 last month but up 6.5% from January 2023. It was a very precipitous decline over the last 3 months. Month-over-month, the house price index is down 0.4% and in the last 6 months down 5.9%.

“With January sales on the rise, we are seeing hopeful signs that optimism is returning to the market,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “Anticipating that we may be at the end of the Bank of Canada rate hike cycle, it appears that more buyers are considering re-entering the market as we are starting to see more traffic at open houses.”