The Roller Coaster Ride Called Real Estate

Download Dec Sales and Listings Statistics All Regional

Download Dec Sales and Listings Statistics Houses Townhouses Condos

Highlights of Dexter’s December 2023 report

- Prices in Greater Vancouver were up 5% in 2023

- Vancouver West Side detached prices showed an increase of 11.4% in 2023

- Total number of New Listings were the lowest since 2001

- Let the interest rate decreases begin

- The Buying signal is now

It would seem interest rates and inflation have made for a bit of a roller coaster ride in real estate with numbers showing we’re likely at the bottom of this rough ride we’ve been on over the last 2 years.

And while people will line up for Disney’s roller coaster, buyers and sellers chose to avoid the ride this year and the numbers certainly showed that. With near record lows for the number of new listings and sales volume declines for the second year in a row, the line up is forming for all those buyers and sellers that want to jump on a smoother ride in real estate. While we may have achieved balance in the real estate market by the end of 2023, will that continue in 2024? Once the Bank of Canada starts to decrease its rate, that will bring more buyers off the sidelines and create competition. Fixed rates have already started to decline. So, for those buyers ready to buy now, this is your buying signal.

January rings in the new year and with that comes every property owner’s assessed value from B.C. Assessment. Perhaps talked about more than new year resolutions as everyone looks to see how their properties scored compared to others. It’s important to remember though that these assessments may not accurately reflect market value and these valuations were done up to July 1, 2023. In the Lower Mainland, the total assessed value of properties was up 3% compared to 2023. With Vancouver seeing a typical property up 4%, one of the highest in the region, along with Burnaby and Coquitlam while most other suburbs were at 2% and municipalities in the Fraser Valley showing a decrease of 2 to 3%. Hope had the highest decline at 13%. BC Assessment Assessor Bryan Murao said, “Most homeowners can expect only modest changes in the range of -5% to +5%. These assessment changes are notably less than previous years.”

At least we beat January, as the 1,345 properties sold in December were higher than the 1,030 sales at the start of 2023 in January. That can be seen as a positive after a year where the real estate market limped along. This after there were 1,702 properties of all types sold in Greater Vancouver in November and 1,996 sales in October. But at least there were more sales this December compared to last year where 1,303 properties sold in the last month of 2022. But still sales in December were 37% below the 10-year average after November’s sales were at 35% below the 10-year average.

Overall, there were 26,249 sales in 2023 which was down from the 29,227 in 2022, and much less than the 44,944 sales in the fast-paced 2021. Total sales for the year were 23 per cent below the 10-year average. The last two down years were 2018 and 2019 with 25,051 and 25,679 sales respectively in those years. Like 2022 with the first six months having the majority of sales, 2023 was no different due to interest rate hikes having their way. In the last half of 2023 there were 11,720 sales compared to 10,348 in the last half of 2022. While it’s early to call it, there is a sense of momentum change. What’s needed to help that shift in the market is more listings. There will be real estate transactions in 2024, just how many will be a function of the number of listings that come on. Sellers, buyers are waiting for you!

With current sales, we are in a balanced market with 7 months supply of homes overall in Greater Vancouver, ticking up from 6 months supply in November. With such a low volume of sales, it’s not surprising to see this. Vancouver’s West Side and West Vancouver are showing numbers above 7 months which indicates a buyer’s market. While North Vancouver, Burnaby Coquitlam, Port Coquitlam, and Pitt Meadows continue to see the shortage of listings resulting in seller’s market conditions with less than 5 months supply.

There were only 1,355 new listings in December after 3,440 new listings in November, 4,752 new listings in October, and 5,557 new listings in September, and slightly higher than the number of new listings in December last year at 1,240. For the year, there were 50,883 new listings in Greater Vancouver, which was below the 55,028 in 2022, and 63,711 in 2021. It was also lower than the two previous down years of 2018 and 2019 where there were 55,057 and 53,267 new listings respectively.

The number of new listings in December dropped to 25% below the 10-year average after being close to or above the average in the last 3 months: 3% below the 10-year average in November, 5% above the average in October and 6% above the average in September. For the year, new listings were 11% below the 10-year average. With these few listings it’s not surprising to see prices climb 5% year-over-year in Greater Vancouver even amid sales that were 23% below the 10-year average. A resilient market indeed.

There were 8,802 active listings in Greater Vancouver at the end of December after November finished with 10,931, compared with 11,599 active listings at the end of October and 11,382 active listings at the end of September. After several listings expired at the end of December, January started with 7,828 active listings. Last year at the end of December there were 7,791 active listings and January 2023 started with 6,853. While we do have more listings to work with currently, there are less than the 10,907 at the end of 2018 and far below the 13,902 active listing at the end of 2012. The detached market overall remains in buyer’s market territory with 9 months supply of inventory but during the month of December the absorption rate was at 91%. Townhomes and condos continue to sit just above 5 months supply of listings on the border of a seller’s market with 106% of new townhome listings selling in December and 104% of condo new listings selling that month.

We do not have a speculation problem; we have a holding problem. More and more real estate is held instead of sold. After 25 years, the number of listings should be higher, the number of transactions should be higher. With our population growing and demographics shifting to produce more buyers, discouraging homeowners from selling will do more harm than good. The proposed anti-flipping tax tabled by the B.C. NDP along with other demand side policies will produce less listings for buyers and put more pressure on prices to increase. Government needs to entice sellers to come to the market and until policy shifts in that direction, we’ll continue to have a holding problem and with limited supply.

Here’s a summary of the numbers:

Greater Vancouver: Month-over-month, the house price index is down 2.9% in the last quarter but up 5.0% year-over-year.

Total Units Sold in December were 1,345 down from 1,702 (21%) in November 2023, down from 1,996 (33%) in October 2023, up from 1,303 (3%) in December 2022, down from 2,737 (51%) in December 2021, down from 3,157 (57%) in December 2020, down from 2,046 (34%) in December 2019, up from 1,094 (23%) in December 2018; Active Listings were at 8,802 at month end compared to 7,791 at that time last year and 10,931 at the end of November; New Listings in December were down 21% compared to November 2023, down 71% compared to October 2023, up 9% compared to December 2022, down 32% compared to December 2021, down 46% compared to December 2020, down 19% compared to December 2019 and up 7% compared to December 2018. Month’s supply of total residential listings is up to 7 month’s supply (balanced to buyer’s market conditions – detached homes up to 9 months supply, a buyer’s market) and sales to listings ratio of 99% compared to 49% in November 2023, 105% in December 2022 and 138% in December 2021.

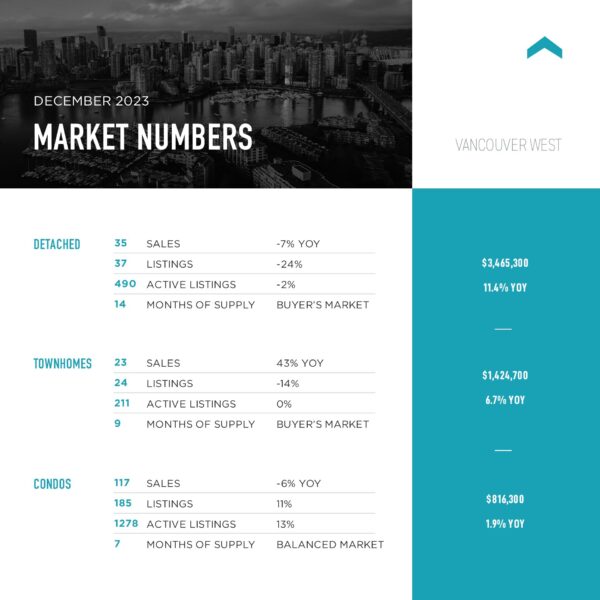

Vancouver Westside: The detached home price index was down 2.5% in the last quarter, but up 11.4% over last year – the highest in the region. A sign at how much equity and less reliant on mortgages Vancouver is. Overall, the benchmark home price index in Vancouver’s West Side was up 5.4% while on the East Side it was up 7.4%. West Side condos saw their benchmark price up 1.9% year-over-year – opportunity for some buyers in that market.

Total Units Sold in December were 235 down from 315 (25%) in November 2023, down from 352 (33%) in October 2023, down from 244 (4%) in December 2022, down from 468 (50%) in December 2021, down from 486 (52%) in December 2020, down from 356 (34%) in December 2019, up from 190 (24%) in December 2018; Active Listings were at 1,998 at month end compared to 1,869 at that time last year and 2,432 at the end of November; New Listings in December were down 63% compared to November 2023, down 75% compared to October 2023, up 2% compared to December 2022, down 38% compared to December 2021, down 42% compared to December 2020, down 19% compared to December 2019 and down 5% compared to December 2018. Month’s supply of total residential listings is up to 9 month’s supply (buyer’s market conditions) and sales to listings ratio of 95% compared to 47% in November 2023, 100% in December 2022 and 118% in December 2021.

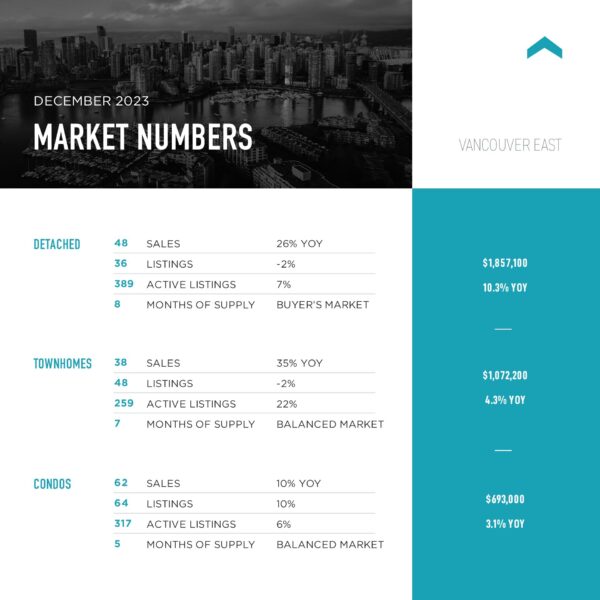

Vancouver East Side: The benchmark price index was down 3% in the last quarter but up 7.4% over last year – with detached homes posting a 10.3% year-over-year increase which was second highest in the region.

Total Units Sold in December were 148 down from 175 (15%) in November 2023, down from 231 (36%) in October 2023, up from 122 (21%) in December 2022, down from 295 (50%) in December 2021, down from 348 (53%) in December 2020, down from 208 (29%) in December 2019, up from 113 (31%) in December 2018; Active Listings were at 977 at month end compared to 880 at that time last year and 1,238 at the end of November; New Listings in December were down 64% compared to November 2023, down 74% compared to October 2023, up 3% compared to December 2022, down 31% compared to December 2021, down 45% compared to December 2020, down 8% compared to December 2019 and up 11% compared to December 2018. Month’s supply of total residential listings is steady at 7 month’s supply (buyer’s market conditions) and sales to listings ratio of 100% compared to 43% in November 2023, 85% in December 2022 and 137% in December 2021.

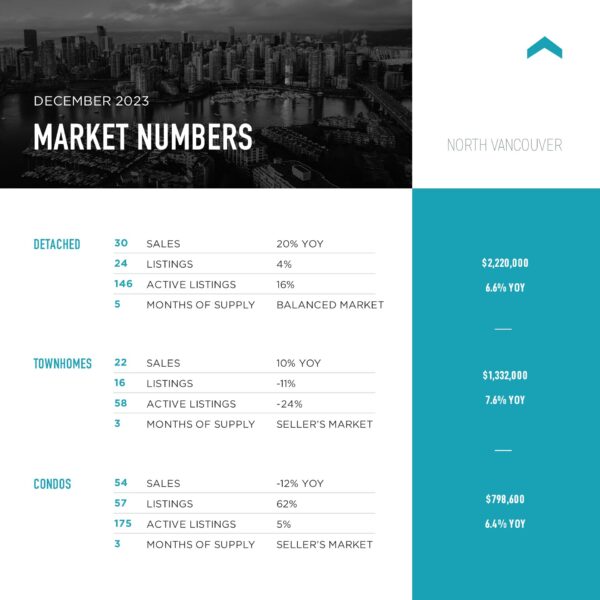

North Vancouver: Again, one of the few seller’s markets for inventory in Metro Vancouver. The benchmark price index was down 1.7% in the last quarter and up 5.2% year-over-year.

Total Units Sold in December were 106 down from 157 (32%) in November 2023, down from 194 (45%) in October 2023, down from 107 (1%) in December 2022, down from 195 (46%) in December 2021, down from 250 (58%) in December 2020, down from 155 (32%) in December 2019, up from 99 (1%) in December 2018; Active Listings were at 392 at month end compared to 385 at that time last year and 560 at the end of November; New Listings in December were down 62% compared to November 2023, down 73% compared to October 2023, up 24% compared to December 2022, down 17% compared to December 2021, down 39% compared to December 2020, down 10% compared to December 2019 and up 27% compared to December 2018. Month’s supply of total residential listings is steady at 4 month’s supply (seller’s market conditions) and sales to listings ratio of 106% compared to 59% in November 2023, 132% in December 2022 and 163% in December 2021.

West Vancouver: West Vancouver saw the house price index drop 4.9% last quarter and posted a 0.9% decline year-over-year. One of the only areas in Greater Vancouver other than the Sunshine Coast and Bowen Island to decline in 2023.

Total Units Sold in December were 41 down from 48 (15%) in November 2023, down from 53 (23%) in October 2023, up from 40 (3%) in December 2022, down from 62 (34%) in December 2021, down from 82 (50%) in December 2020, down from 46 (11%) in December 2019, up from 30 (37%) in December 2018; Active Listings were at 487 at month end compared to 448 at that time last year and 593 at the end of November; New Listings in December were down 62% compared to November 2023, down 68% compared to October 2023, up 15% compared to December 2022, up 8% compared to December 2021, down 19% compared to December 2020, down 10% compared to December 2019 and down 16% compared to December 2018. Month’s supply of total residential listings is steady at 12 month’s supply (buyer’s market conditions) and sales to listings ratio of 76% compared to 34% in November 2023, 85% in December 2022 and 124% in December 2021.

Richmond: The benchmark price index declined 2.6% in the last quarter and was up 6% in 2023 with condos leading the way at 8.9%.

Total Units Sold in December were 169 down from 179 (6%) in November 2023, down from 217 (22%) in October 2023, down from 171 (1%) in December 2022, down from 387 (56%) in December 2021, down from 343 (51%) in December 2020, down from 281 (40%) in December 2019, up from 122 (39%) in December 2018; Active Listings were at 1,043 at month end compared to 919 at that time last year and 1,258 at the end of November; New Listings in December were down 60% compared to November 2023, down 66% compared to October 2023, down 6% compared to December 2022, up 41% compared to December 2021, down 46% compared to December 2020, down 36% compared to December 2019 and down 19% compared to December 2018. Month’s supply of total residential listings is down to 6 month’s supply (balanced market conditions) and sales to listings ratio of 104% compared to 44% in November 2023, 99% in December 2022 and 140% in December 2021.

Burnaby East: The benchmark price index declined 1.9% in the last quarter and was up 6% in 2023 with detached homes leading the way at 9.5%.

Total Units Sold in December were 18 up from 13 (39%) in November 2023, down from 21 (14%) in October 2023, up from 12 (50%) in December 2022, down from 32 (44%) in December 2021, down from 41 (56%) in December 2020, down from 24 (25%) in December 2019, up from 17 (6%) in December 2018; Active Listings were at 75 at month end compared to 76 at that time last year and 93 at the end of November; New Listings in December were down 60% compared to November 2023, down 75% compared to October 2023, down 14% compared to December 2022, down 45% compared to December 2021, down 37% compared to December 2020, down 43% compared to December 2019 and down 40% compared to December 2018. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 150% compared to 43% in November 2023, 86% in December 2022 and 145% in December 2021.

Burnaby North: The benchmark price index declined 2% in the last quarter and was up 3.3% in 2023 with detached homes leading the way at 9%.

Total Units Sold in December were 91 down from 119 (23%) in November 2023, down from 137 (34%) in October 2023, up from 78 (17%) in December 2022, down from 157 (42%) in December 2021, down from 171 (47%) in December 2020, down from 113 (19%) in December 2019, up from 50 (82%) in December 2018; Active Listings were at 417 at month end compared to 353 at that time last year and 549 at the end of November; New Listings in December were down 58% compared to November 2023, down 73% compared to October 2023, up 11% compared to December 2022, down 35% compared to December 2021, down 53% compared to December 2020, up 11% compared to December 2019 and down 2% compared to December 2018. Month’s supply of total residential listings is steady at 5 month’s supply (balanced market conditions) and sales to listings ratio of 117% compared to 64% in November 2023, 111% in December 2022 and 130% in December 2021.

Burnaby South: The benchmark price index declined 2.7% in the last quarter and was up 4% in 2023 with townhomes leading the way at 9.6%.

Total Units Sold in December were 79 down from 83 (5%) in November 2023, down from 120 (34%) in October 2023, down from 94 (16%) in December 2022, down from 186 (57%) in December 2021, down from 148 (57%) in December 2020, down from 132 (40%) in December 2019, up from 51 (55%) in December 2018; Active Listings were at 395 at month end compared to 344 at that time last year and 487 at the end of November; New Listings in December were down 55% compared to November 2023, down 67% compared to October 2023, up 27% compared to December 2022, down 44% compared to December 2021, down 48% compared to December 2020, down 4% compared to December 2019 and down 26% compared to December 2018. Month’s supply of total residential listings is down to 5 month’s supply (balanced market conditions) and sales to listings ratio of 105% compared to 50% in November 2023, 159% in December 2022 and 138% in December 2021.

New Westminster: With an average price of $800,300, New Westminster continues to scream opportunity but with a slow listing month, that may not last long. The benchmark price index declined 3% in the last quarter and was up 5.3% in 2023 with both detached homes and condos leading the way at 6.6%.

Total Units Sold in December were 46 down from 65 (29%) in November 2023, down from 81 (43%) in October 2023, down from 53 (7%) in December 2022, down from139 (67%) in December 2021, down from 151 (69%) in December 2020, down from 77 (40%) in December 2019, down from 58 (21%) in December 2018; Active Listings were at 240 at month end compared to 219 at that time last year and 302 at the end of November; New Listings in December were down 70% compared to November 2023, down 74% compared to October 2023, up 35% compared to December 2022, down 54% compared to December 2021, down 58% compared to December 2020, down 23% compared to December 2019 and down 15% compared to December 2018. Month’s supply of total residential listings is steady at 5 month’s supply (balanced market conditions) and sales to listings ratio of 118% compared to 50% in November 2023, 183% in December 2022 and 164% in December 2021.

Coquitlam: The benchmark price index declined 2.3% in the last quarter and was up 3.4% in 2023 with detached homes leading the way at 6.4%.

Total Units Sold in December were 119 down from 159 (25%) in November 2023, down from 167 (29%) in October 2023, up from 81 (47%) in December 2022, down from 216 (45%) in December 2021, down from 309 (61%) in December 2020, down from 197 (40%) in December 2019, up from 89 (34%) in December 2018; Active Listings were at 527 at month end compared to 452 at that time last year and 721 at the end of November; New Listings in December were down 70% compared to November 2023, down 79% compared to October 2023, up 13% compared to December 2022, down 44% compared to December 2021, down 59% compared to December 2020, down 37% compared to December 2019 and down 37% compared to December 2018. Month’s supply of total residential listings is down to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 138% compared to 55% in November 2023, 107% in December 2022 and 140% in December 2021.

Port Moody: The benchmark price index declined 0.6% in the last quarter and was up 3.8% in 2023 with townhomes leading the way at 8.3%.

Total Units Sold in December were 25 down from 40 (37%) in November 2023, down from 51 (51%) in October 2023, down from 41 (39%) in December 2022, down from 52 (52%) in December 2021, down from 78 (68%) in December 2020, down from 37 (32%) in December 2019, up from 29 (14%) in December 2018; Active Listings were at 128 at month end compared to 155 at that time last year and 166 at the end of November; New Listings in December were down 63% compared to November 2023, down 62% compared to October 2023, down 24% compared to December 2022, down 18% compared to December 2021, down 37% compared to December 2020, up 14% compared to December 2019 and up 100% compared to December 2018. Month’s supply of total residential listings is up to 5 month’s supply (balanced market conditions) and sales to listings ratio of 78% compared to 47% in November 2023, 98% in December 2022 and 133% in December 2021.

Port Coquitlam: The benchmark price index declined 2.5% in the last quarter and was up 5.4% in 2023 with detached homes leading the way at 7.9%.

Another one of the few municipalities with seller’s market conditions. Total Units Sold in December were 36 down from 55 (34%) in November 2023, down from 54 (33%) in October 2023, down from 37 (3%) in December 2022, down from 107 (66%) in December 2021, down from 105 (66%) in December 2020, down from 84 (57%) in December 2019, down from 51 (29%) in December 2018; Active Listings were at 154 at month end compared to 140 at that time last year and 183 at the end of November; New Listings in December were down 57% compared to November 2023, down 66% compared to October 2023, down 11% compared to December 2022, down 41% compared to December 2021, down 62% compared to December 2020, down 32% compared to December 2019 and down 2% compared to December 2018. Month’s supply of total residential listings is up to 4 month’s supply (seller’s market conditions) and sales to listings ratio of 92% compared to 61% in November 2023, 84% in December 2022 and 162% in December 2021.

Pitt Meadows: The benchmark price index declined 4.5% in the last quarter and was up 4.4% in 2023 with condos leading the way at 7.1%.

Total Units Sold in December were 19 down from 21 (9%) in November 2023, down from 21 (9%) in October 2023, down from 23 (17%) in December 2022, down from 33 (42%) in December 2021, down from 26 (27%) in December 2020, down from 27 (30%) in December 2019, up from 11 (27%) in December 2018; Active Listings were at 59 at month end compared to 54 at that time last year and 83 at the end of November; New Listings in December were down 56% compared to November 2023, down 70% compared to October 2023, up 16% compared to December 2022, down 50% compared to December 2021, down 30% compared to December 2020, up 8% compared to December 2019 and down 18% compared to December 2018. Month’s supply of total residential listings is down to 3 month’s supply (seller’s market conditions) and sales to listings ratio of 135% compared to 53% in November 2023, 191% in December 2022 and 117% in December 2021.

Maple Ridge: The benchmark price index declined 3.8% in the last quarter and was up 5.5% in 2023 with detached homes leading the way at 6.7%.

Total Units Sold in December were 100 down from 103 (3%) in November 2023, down from 110 (9%) in October 2023, up from 78 (28%) in December 2022, down from 159 (37%) in December 2021, down from 214 (53%) in December 2020, down from 130 (23%) in December 2019, up from 73 (37%) in December 2018; Active Listings were at 579 at month end compared to 442 at that time last year and 718 at the end of November; New Listings in December were down 49% compared to November 2023, down 69% compared to October 2023, up 56% compared to December 2022, down 6% compared to December 2021, down 38% compared to December 2020, down 3% compared to December 2019 and up 44% compared to December 2018. Month’s supply of total residential listings is down to 6 month’s supply (balanced market conditions) and sales to listings ratio of 98% compared to 51% in November 2023, 120% in December 2022 and 145% in December 2021.

Ladner: The benchmark price index declined 4.8% in the last quarter and was up 5.9% in 2023 with townhomes leading the way at 9.4%.

Total Units Sold in December were 12 down from 21 (43%) in November 2023, down from 24 (50%) in October 2023, up from 9 (33%) in December 2022, down from 21 (43%) in December 2021, down from 34 (65%) in December 2020, down from 20 (40%) in December 2019, down from 23 (48%) in December 2018; Active Listings were at 86 at month end compared to 72 at that time last year and 104 at the end of November; New Listings in December were down 46% compared to November 2023, down 68% compared to October 2023, the same compared to December 2022, up 17% compared to December 2021, down 53% compared to December 2020, down 53% compared to December 2019 and the same compared to December 2018. Month’s supply of total residential listings is up to 7 month’s supply (balanced market conditions) and sales to listings ratio of 86% compared to 81% in November 2023, 64% in December 2022 and 175% in December 2021.

Tsawwassen: The benchmark price index declined 3.4% in the last quarter and was up 6.4% in 2023 with detached homes leading the way at 8.8%.

Total Units Sold in December were 21 up from 20 (5%) in November 2023, down from 27 (22%) in October 2023, down from 23 (9%) in December 2022, down from 43 (51%) in December 2021, down from 74 (72%) in December 2020, down from 26 (19%) in December 2019, up from 13 (38%) in December 2018; Active Listings were at 152 at month end compared to 130 at that time last year and 180 at the end of November; New Listings in December were down 60% compared to November 2023, down 76% compared to October 2023, down 10% compared to December 2022, down 10% compared to December 2021, down 58% compared to December 2020, down 5% compared to December 2019 and up 39% compared to December 2018. Month’s supply of total residential listings is down to 7 month’s supply (balanced market conditions) and sales to listings ratio of 117% compared to 44% in November 2023, 115% in December 2022 and 215% in December 2021.

Fraser Valley: Sales in December were down 7% from November but up 19% from December 2022. New listings were down 56% from November but up 16% from December 2022. While the average price was down 2.5% month-over-month, it is up 4% from December 2022. Active listings were down 30% to 3,992 from 5,726 last month but up 4% from December 2022. “Back-to-back mid-year interest rate hikes slowed the market despite strong sales and new listings in the spring,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This left the market in overall balance for the latter half of the year, albeit at low levels of activity. We anticipate 2024 will bring increased optimism on behalf of buyers and sellers as the Bank of Canada is expected to lower interest rates before mid-year.”