A year ends with a flourish and a new year begins with confidence.

Download December Sales and Listings Statistics Houses Townhouses Condos

Download December Sales and Listings Statistics All Regional

We will all remember the 2022 housing market as one of the most volatile that Metro Vancouver has ever seen, rising to unprecedented highs early in the year only to fall to a near 40-year low by December. Along the way the year crushed every cliché in the residential market. January and February sales, normally the slowest sales months of the year, were among the strongest. September, traditionally a stellar month, posted lower sales than August.

Year-over-year sales fell about 50% but prices proved amazingly resilient, with a mere 3.3% decrease in the benchmark composite home price. Most strata prices increased. And, to cap it all off, the normally sedate December posted a sales-to-new-listing ratio of more than 100% to put an exclamation point on an unforgettable year.

It is all rather reminiscent of 2018, and for a similar reason: anti-demand government policies – – including seven consecutive interest rate increases in 2022 – putting the brakes on eager buyers. The one major difference from 2018, sellers were far more absent as new listings were far more scarce.

We all must deal with continued government intervention in 2023, none of which address the underlying problem of a lack of supply in Metro Vancouver’s housing market. The shortage of both resale listings and new home construction was starkly apparent in December 2022, when total listings of homes was down 41% compared to a year earlier and new listings plunged 60% from November 2022.

At the same time, starts of new non-rental homes in Metro Vancouver fell to 13,950 units as of December 1, down from 17,708 in the same period in 2021. And the government’s response to this dramatic shortfall? The complicated new and largely unnecessary B.C. Land Owner Transparency Registry, which became mandatory on November 30 on residential purchases and require a lawyer’s assistance to complete; a two-year federal ban on foreign homebuyers, which began January 1, 2023 and will discourage new speculative construction as immigration levels reach record highs; and B.C.’s unnecessary three-day cooling off period for homebuyers, effective January 3, 2023, in a market where the average listing now takes 31 days to sell. While giving buyers 3 days to decide if they want to move forward, it doesn’t technically allow for due diligence by a buyer and imposes a penalty on buyers if they want to rescind. As well, several Metro municipalities are increasing development cost charges on new home construction, even as developers are reeling from higher construction costs and land prices and slowing pre-sales of new strata units.

When you consider what this market deals with, its resiliency is amazing and quite encouraging as we enter a new year, especially for homebuyers. The bottom line is that, with more than 50,000 new immigrants expected to arrive in B.C. in 2023 and governments pushing to stunt the housing supply, Metro Vancouver home prices will continue to face upward pressure.

December was likely a harbinger of what is to come. With just 1,240 new listings in the month, there were 1,303 sales, resulting in a sales-to-new-listing of a startling 105%. This is not indicative of slowing demand or owners desperate to sell.

We’ve not seen new listings for the month of December this low going back as far as 1991 in Greater Vancouver. If anyone thinks sellers are panic selling, this suggests the exact opposite and sets up 2023 to be a year with a skinny selection in front of hungry buyers. While the story of the real estate market tends to be the lack of sales that occurred in the second half of 2022, the drop in listings is the true underlying theme in the real estate market.

December benchmark prices are also an eye-opener. Despite all the angst in 2022, the forecasts of recession and a crash in values, average home prices are virtually the same now as 12 months ago. The overall average composite home price in December was $1,183,802, only $57,000 (or 4.2%) below the near-record price a year earlier. Some markets and housing types have higher average prices now than 12 months ago, including the bellwether Westside of Vancouver, where condo apartment prices have increased $30,000 and the East Side of Vancouver, where average townhouse prices in December were up about $120,000 from the end of 2021.

Based on current trends, 2023 looks like more of the same: gently rising home prices against a background of increased demand and a tight supply. Without more listings on the market, the true strength of this emerging buyer’s market will not be fully realized.

Here’s a summary of the numbers:

Greater Vancouver: This is a balanced market, with only a low supply keeping it from tipping to a full-blown buyer’s market. Total units sold in December were 1,303 and total new listings were 1,240, resulting in a 105% sales-to-new-listing ratio, one of the highest in all of 2022. New listings were down 61% from November 2022 and 38% lower than in December 2021, which hampered many buyers. More listings would have resulted in higher sales, without a doubt. The low supply assured prices would remain constant, with the composite benchmark price in December at $1,131,600, down less than $20,000 from December 2021. With a further 55,000 international immigrants expected to arrive in 2023, listings in short supply and rents at record highs, the price pressure on homes is becoming intense.

Vancouver Westside: This is the most-watched housing market in B.C. and it provides all the evidence needed that we are heading into a buyer’s market, with eager purchasers held in check only by a lack of supply. Despite an average price of nearly $3,489,1341 in December, 78% of new listings for detached houses sold. In the condominium apartment market, the sales success ratio was 114% and the average price of $993,400 was 3.1% higher than both a month and a year earlier. The townhouse sector saw December sales sag to 16, largely because new listings dropped to just 28 units, the lowest monthly level in at least two years. Still, the average Westside townhouse price in December was $1,566,761, the highest since July 2022. The supply of total residential listings is still at 8 month’s supply, representing perhaps an irresistible buyer’s market as we head into 2023.

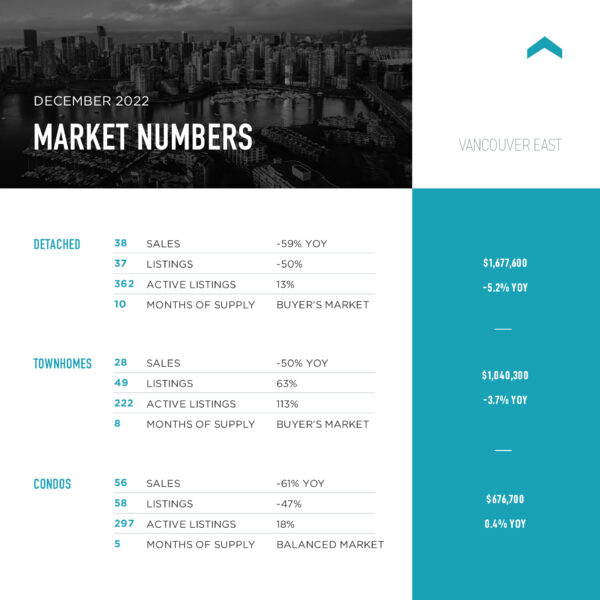

Vancouver East Side: Next year is when it all comes together for the East Side housing market. The Broadway Plan is pushing density higher from Renfrew Street to Mount Pleasant with the new SkyTrain Subway as the development of the 450-acre False Creek Flats and its new St. Paul’s Hospital kick into high gear. Relaxed zoning allows three housing units on each detached lot and rental rates are soaring. Heady times indeed and savvy buyers and investors have started early. In December, 38 detached houses sold, representing 103% of the new listings available. Yet the average detached house price, at $1,766,997, is the lowest since December 2020 and half the price as the neighbouring Westside. Condos are also attractive for East Side buyers: the sales-to-new-listing ratio in December was 97% and the benchmark price has barely budged (down 0.5%) from a year ago. This is the market to get into now, while there is seven-month supply of homes available and prices are holding steady. We doubt that will be the case three months from now.

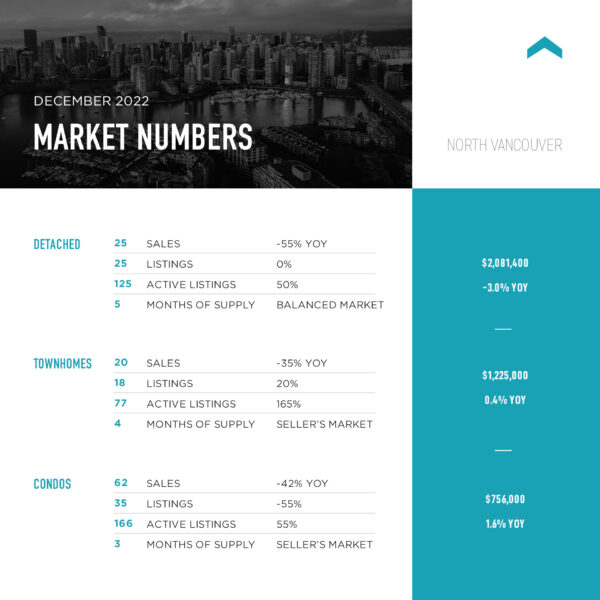

North Vancouver: The overall sales-to-listing ratio in December was a startling 132% and there is only a 4-month supply of listings on the market, setting the stage for a very competitive market. Total sales were down 45% from a year earlier, to 107, but new listings dropped 32% year-over-year and were down nearly 70% from November 2022. The condo market is a sector to watch. The Lonsdale Quay/ Lower Lonsdale area is now a destination and was responsible for many of the 1,208 North Vancouver condo sales in 2022. Benchmark condo prices at $756,000 in December are up 1.6% from a year ago but have been declining an average of 1.5% per month since the spring. Be careful shopping in the new pre-sale strata market in North Vancouver City and District, which have brought in the Step 5 (net-zero) building code, which adds expenses and delays due to new super-energy-saving construction. All homes are in short supply, with just 385 active listings as of the end of December, down from 529 a month earlier.

West Vancouver: Total housing sales in December, with 40 transactions, were down 34% from December of 2021 but up from the 28 sales in November 2022. Active listings were 448 at month end, but new listings in December were down 58% from November and 6% lower than a year earlier. This market is defined by its detached housing, which posted an impressive 124% sales-to-new-listing ratio in December as 26 houses sold at an average price of just slightly under $3 million. The supply of total residential listings is down to an 11 month’s supply (buyer’s market conditions) and the sales to listings ratio of 85% compares to 25% in November 2022. This is a buyer’s market but don’t expect dramatically lower prices. The overall December benchmark, at $2,559,400, was still nearly 19% higher than in pre-pandemic 2019.

Richmond: If any market will feel the brunt of the two-year foreign homebuyer ban it will likely be Richmond, but the ban is rather toothless because of exceptions to the federal legislation in force from Jan. 1, 2023. Foreigners with a spouse or common-law partner who is a Canadian are exempt as the spouse or partner would be the purchaser, as are permanent residents (those who have immigrated but are not yet citizens), foreigners with temporary work permits, refugees and most long-term international students can take advantage of exemptions depending on their situation. December sales in Richmond, at 171, were the lowest in three months and down 56% from December 2021. But there is a good selection for buyers, with 919 total listings at month’s end, compared to 723 a year ago. The benchmark price for a detached house is $1,978,200, down nearly 3% from November 2022. A total of 96 townhouses sold in December at a benchmark of $1,049,800, a price unchanged from three months earlier. Condo apartment sales benchmarked at $689,400, up 6% from December 2021. With a sales-to-listing ratio at 99% and a 5-month supply of listings, this is a balanced market.

Burnaby East: This sub-market posted just 12 sales in December, a small share of the 183 transactions across Burnaby in the month, but it also had the highest benchmark home price in the municipality, at $1,082,300. Detached house prices, benchmarked at $1,657,400, were down 5.1% from a month earlier and 6% lower than a year ago. Total active listings of 74 at month’s end were more than doubled a year earlier, but new listings dropped 62% from a month earlier. There is a 6-month supply, and the sales-to-new-listing is running at a quick 86%, up from 38% in November 2022.

Burnaby North: Housing sales continue to track lower, with 78 December sales down from 92 a month earlier and 50% lower than in December 2021. Prices are holding fairly firm, however, with the condo apartment price at $692,500, up 2.7% from year earlier. (The sixth residential tower – 396 units – at Brentwood started in December after the first five towers sold out). This is overall a balanced market with a 5-month supply, but the sales-to-listing ratio of 111%, the highest in at least four years, and solid prices mark it as a seller’s advantage.

Burnaby South: Most of Burnaby’s housing sales – 94 – were in the South in December and this may continue due to the explosion of condo construction in the Metrotown area. Sales were down 20% from November 2022 and 49% lower than in December 2021. Prices are sticky, though, with composite benchmark price at $ $965,300, virtually unchanged (down 1.1%) from a year ago. Detached house prices have held rock-steady for the year at $1,889,000, down 0.5% from December 2021. There are 344 total listings in this seller’s market, down from 425 in November 2022, and the sales-to-new-listing ratio is a robust 159%, one of the highest in Metro Vancouver.

New Westminster: The Royal City remained a seller’s market in December, with a sales-to-new-listings ratio of 183% – up from 164% a year ago – and just a 4-month supply of homes on the market, with 219 total listings. A total of 53 properties sold in December, down 18% from November and 61% below December 2021. The detached house benchmark price is $1,402,600, down 4.3% from a year ago, but townhouse ($872,800) and condo apartment ($619,400) prices are up by same amount year-over-year. Incidentally, New Westminster’s new council has been moving to speed residential developments with some sharp new ideas on quicker approvals. A market to watch in 2023.

Coquitlam: All Tri-Cities communities are raising or considering increases in development cost charges for residential development, so we will likely be seeing higher prices for new product in 2023. Meanwhile new listings in December were down 69% from November and active listings, at 452 at month’s end, were down from 582 a month earlier, while the sales-to-new-listing ratio is running hot at 107%. Total sales in December were 81, down 40% from November and 42% below December 2021. The composite home price in December, at $1,044,700 is down 3.1% from a year earlier, while detached house benchmarks have slipped down 2.6% year-over-year to $1,698,400, in what is considered a balanced market.

Port Moody: Total sales in this seller’s market were 41 in December, up 24% from November and down a modest 7% from a year earlier. Active listings were at 155 at month’s end compared to 97 at that time last year and 194 at the end of November. But, with the sales-to-new-listing ratio at 98%, listings are disappearing. The composite home price is at $1,079,300, up 1% from December 2021.

Port Coquitlam: The small city has posted its 2023 fee increases, including for residential development, and they remain relatively modest (a multi-family rezoning amendment costs $2,500 plus $200 per unit for each of the first 20 units, as an example). In December 37 residential properties sold, down 65% from December 2021. The sales-to-new-listing ratio is 84%, a reflection of the very low new listings, with just 11 houses, 9 townhouses and 24 condos added to the market in December. This is tight seller’s market, with just a 4-month supply of total listings and the composite home price down just 0.5% from a year ago, at $886,300.

Pitt Meadows: Pitt Meadows was a popular destination during the pandemic, and the housing market has kept strong this year. Only 23 properties sold in December, compared to 33 at the same time a year ago, but were higher than in both October and November 2022. A 57% drop in new listings month-over-month led to a blistering 191% sales-to-new-listing ratio in December, the highest in years. With just a 2-month supply on the market, the composite benchmark home price is down 8.1% from a year ago at $853,400, but it could increase if the supply remains tight

Maple Ridge: At $1,666,600 the benchmark price of a detached house dropped 15.4% in December compared to December 2021, the biggest year-over-year price decline in Metro Vancouver. Still, with sales of 78 in December and new listings down 65% from a month earlier, the sales-to-new-listing ratio was 120%, compared to 50% in November this is considered a balanced market. But buyers may start looking, as the composite home price is now $915,800, down 24.6% from six months ago.

Ladner: Total units sold in December were 9, down from 16 (-44%) in November 2022 and down from 21 (-57%) in December 2021. Benchmark prices are lower across the board, with detached houses down 12.3% from six months ago at $1,299,400; townhouses down 11.2% from June 2022 at $880,200; and condo apartments selling in December at a benchmark of $670,400, about 9% lower than six months ago, but still 34% higher than in pre-pandemic 2019.

Tsawwassen: With 23 sales in December, transactions were 47% below the same month last year and the composite home price fell 13.4% from six months ago and was down 4.4% year-to-year at $1,143,900. Overall home prices are still 26% above pre-pandemic December 2019. Active listings were 130 at month’s end compared to 68 at that time last year and 150 at the end of November 2022. The sales-to-new-listing ratio is a robust 115% in this balanced market, but slowing sales indicate further price corrections could be coming.

Surrey: Sales continue to tumble in B.C.’s second-largest city. Detached house sales fell nearly 70% in December from the same month a year earlier and were down 13.6% compared to November, to 102. The benchmark detached house price is feeling the sales slump, dropping 8.5% year-over-year to $1,510,400. Condo apartment sales plunged a stunning 79% from December 2021 and townhouse sales are down 69% year-over-year, with prices down about 2.5% to $502,800 for condos and $812,200 for townhouses. Even with new listings coming down, we call this a buyer’s market because of the lower prices being seen in one of B.C.’s fastest-growing city.